Dracula Protocol Audited and Enters Deflation Phase

Dracula Protocol inflation period has now ended and the platform has gone through security reviews positively. Moving forward, the DeFi farming protocol will be burning more DRC tokens than it mints. The Dracula token is now deflationary!

DRC Tokenomics

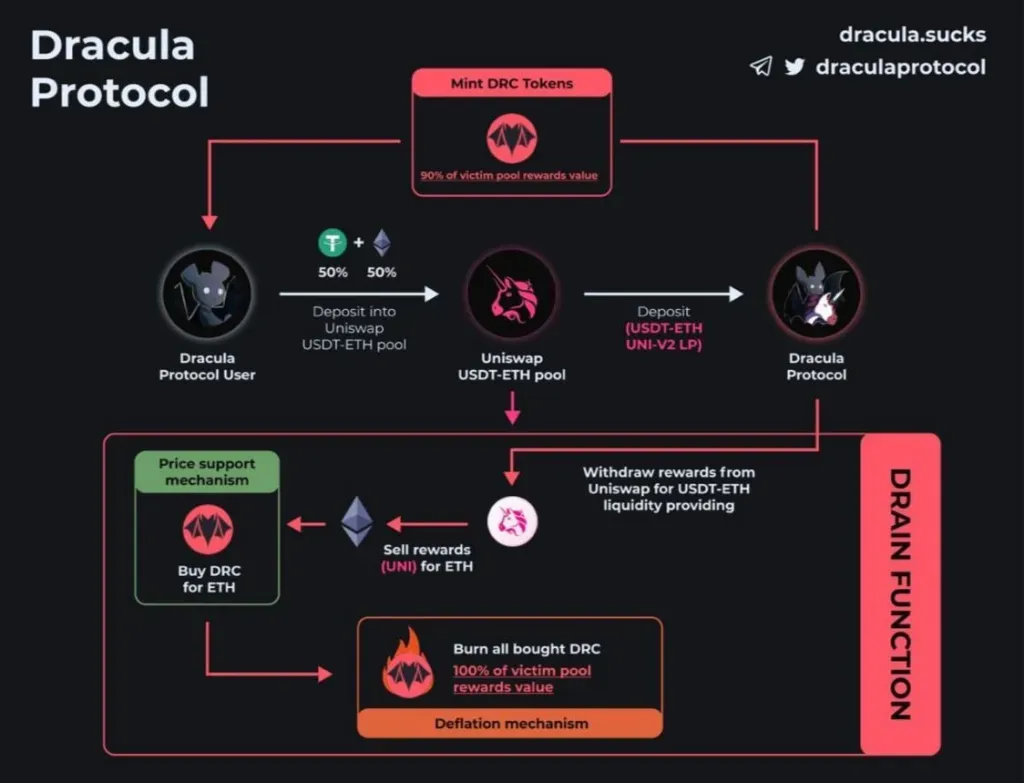

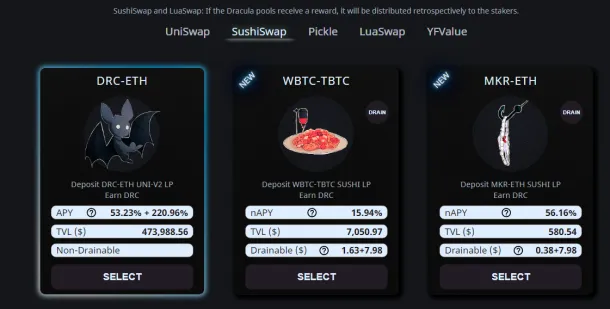

When a user deposits funds in one of Dracula’s pools, the funds go into a target victim protocol to autonomously farm the rewards. Currently, the team has developed adapters to target Uniswap, LuaSwap, Pickle, or SushiSwap. They have also mentioned the next upgrade will add adapters for Harvest Finance. Essentially, the adapters are a proxy contract that turns Dracula Protocol into one big staker in the victim’s protocol allowing it to harvest the rewards.

When harvesting rewards, the protocol uses the drain function to automatically sell the rewards for ETH via Uniswap. It then uses this ETH to buyback DRC and burns these tokens. The idea is to create upwards buying pressure, which will reward DRC token holders in the long run. Because the total amount of DRC in circulation is constantly decreasing, the asset is becoming more scarce, which can potentially cause the price to go up.

Furthermore, this type of design protects the protocol from large whale farmers who just want to dump free tokens and move on. Because the more value locked in the protocol results in bigger buybacks and bigger burns.

Making DeFi ecosystem safer

Team Dracula is also working to improve the overall DeFi ecosystem. The team recently highlighted a severe SushiSwap smart-contract bug, which is most likely present in numerous clone platforms. Though the attack would require admin rights of the MasterChef contract. A malicious operator could cause the loss of user’s rewards or mint unlimited SUSHI tokens.

This issue is not present in Dracula Protocol. Additionally, the blog post points out these risks were missed by several top security auditing firms such as Peckshield, Quanstamp, Slowmist, Arcadia Group, and TomoChain. Essentially, highlighting that community auditors who follow DeFi protocols closely may provide better audits.

Protocol Code Audited

Dracula Protocol has gone through two community audits. One was live-streamed by the well known independent Ethereum auditor NCyotee. A second audit was done by Valentin Mihov, ex CTO of Santiment. Both audits did not find any security issues.

0/ I was approached by @DraculaProtocol to do a security review of their smart contracts. I do this work for private clients, so I haven't published such reports recently. I decided to take the offer and do the review as this protocol is interesting to me https://t.co/eZjrefOgbn pic.twitter.com/hNoVcCClsc

— Valentin Mihov 🦞🇪🇹🦇🔊 (@valentinmihov) October 16, 2020

Additionally, the team implemented further safeguards into their adapters to protect users from flash loan attacks. Flash loan attacks have been used in the past to drain pools completely. So this type of forward-thinking is great to see. You can follow the latest updates via their Twitter. Or hop in their telegram or discord to chat with the community.