Vampire Bite: SushiSwap leaves Uniswap behind

SushiSwap has taken its large vampire bite out of Uniswap, holding 225% more in Total Value Locked post-migration. Essentially, SushiSwap successfully migrated the liquidity away from Uniswap and into its protocol. And the numbers show wonders!

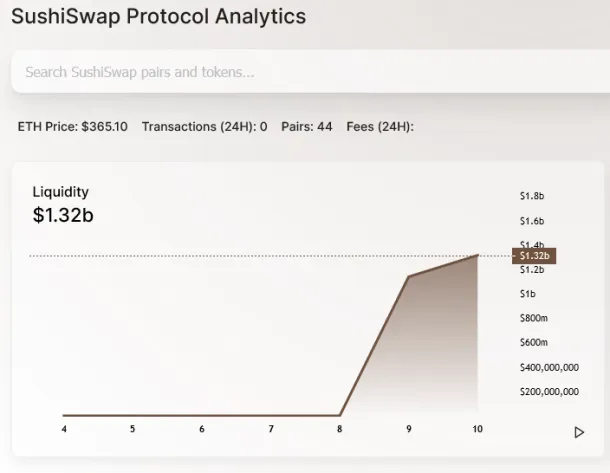

Looking at the data, there is currently $1.3 billion of liquidity locked up in SushiSwap. Whereas, Uniswap is far behind with only about $400 million.

SushiSwap Leaves Uniswap Behind

SushiSwap, the forked Uniswap protocol, is now operating entirely on its own. Meaning there is no longer any need to stake Uniswap LP tokens. Liquidity providers wishing to join the new platform, simply deposit their assets directly into SushiSwap. And then stake the native Sushi LP tokens to earn rewards.

Amazingly the migration process went smoothly and only took a couple of hours. All of this was overseen by CEO of the popular cryptocurrency exchange FTX, Sam Bankman-Fried. SBF recently took over the project from the controversial anonymous developer Chef Nomi.

It’s an amazing milestone for the DeFi project that has been blazing through the industry since day 1. Looking at the new website for interacting directly with SushiSwap, it appears to be a carbon copy of the Uniswap website with some small color changes. But, that is not a surprise as nearly everyone forks Uniswap’s UI.

Similar Flavor:

- Kimchi DeFi is Looking Delicious?

- How to turn $200 into $250k trading buggy DeFi tokens

- What is Hakka Finance and BlackHoleSwap?

What do the numbers say?

Analytics website sushiswap.vision, reports that total liquidity locked is roughly $1.32 billion. Compared to Uniswap’s mere $400 million, it appears as if SushiSwap has left Uniswap behind in the dust. However, this is not the only metric we should judge, Uniswap’s volume and the overall token count is still much higher than the fork.

This could be simply due to Uniswap vast integrations into Ethereum wallets and dApps. Developers will undoubtedly start to integrate SushiSwap to ensure they offer their users the best rates. Interestingly, 1inch, the founders of Mooniswap reported they were already ready.

Here it is - @SushiSwap now integrated 🍣 👌#DeFi https://t.co/nfOayCoyZ8 pic.twitter.com/cA6K2GNUhu

— 1inch Network (@1inch) September 9, 2020

What remains to be seen is if liquidity providers will stick around once the generous SUSHI rewards slow down. Especially, given the recent dumping of top DeFi tokens where SUSHI saw heavy losses. Though the project may already have figured out the answer to this dilemma.

2 Million SUSHI Airdrop

People who stayed loyal to the project and held during the migration, are going to enjoy an incoming airdrop of 2 million SUSHI tokens. With 1 million of these SUSHI tokens coming from SBF’s own holdings. The community then started a proposal to add an additional 1 million SUSHI tokens from the development fund.

Other key figures in the DeFi space believe that this may just be a trend. Andre Cronje, the founder of the popular Yearn Finance DeFi protocol, pointed out that liquidity providers have no loyalty at all.

I don't have a horse in this race, but I do like accurate data

— Andre Cronje (@AndreCronjeTech) September 10, 2020

The narrative that @SushiSwap took TVL from @UniswapProtocol is simply false

Uniswap TVL pre/post Sushiswap remains unchanged

Sushiswap simply took their liquidity locusts with them

Only the liquidity locusts win pic.twitter.com/qr3UBn2paT

He describes them as locusts, stating that right now Sushiswap’s success is subsidized. Time will tell.