What is Narwhalswap? Automated Market Maker on BSC

Narwhalswap is an Automated Market Maker on Binance Smart Chain. It offers users liquidity mining rewards in NAR tokens for staking assets in pools. Much like Pancakeswap or Cream Finance, the project is embracing the faster and cheaper transactions found on BSC.

What is Narwhalswap?

First, let’s visit the name because it is a clever jab at Uniswap on Ethereum. Essentially the team is saying because the Unicorn is not a real creature, Uniswap is not living in reality. Meaning that Uniswap cannot truly exist because the Ethereum network is congested and slow due to high transaction costs. Whereas the Narwhal looks like a Unicorn and does exist in the ocean – where it thrives!

The team is saying that It’s not feasible for a DeFi platform to scale on Ethereum. However, in Binance Smart Chain’s ocean, the possibilities are endless. Hence the name Narwhalswap. At its core, it is an AMM protocol, that enables users to pool funds and stake LP tokens to earn rewards in NAR tokens.

What is NAR token?

Narwhal Protocol Token (NAR) aims to provide long term sustainability to the DeFi platform. As a result, NAR token provides holders with voting rights and also equity. Essentially, the team wants to avoid the project collapsing because whale farmers received too many rewards. Currently, the DeFi landscape is filling up with projects that rose very high and then abruptly dropped down to near zero value. There is no infinite inflation with NAR as the total supply is fixed at 21,000,000 NAR.

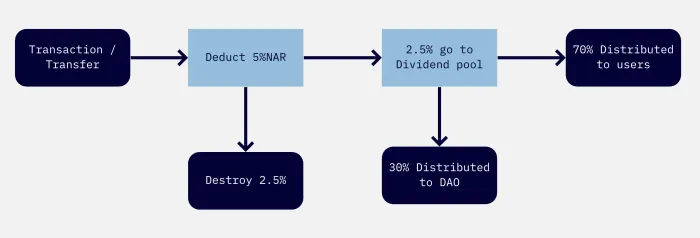

There is also a 5% burn rate which happens when a user transfers NAR token. However, only 2.5% is destroyed, the other 2.5% is transferred to a dividend pool. In the future, NAR token holders will claim rewards from the dividend pool. Additionally, there are plans to enable users to pay swap fees in NAR tokens instead of the pool’s native token.

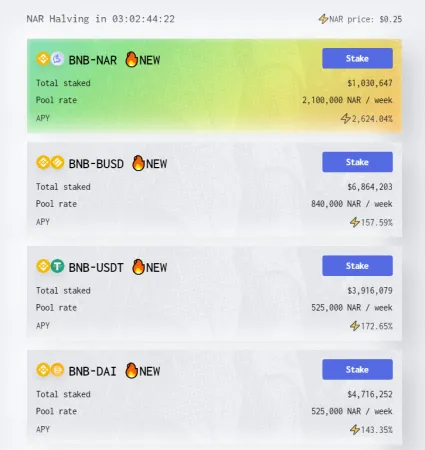

Sustainable Liquidity Mining

Narwhalswap does not take the typical approach to liquidity mining, as the team aims to provide a long term ecosystem for farmers. Their algorithm promotes more participants to start staking and providing liquidity, as it aims to keep the reward distribution fair. This is done by calculating a user’s NARPOWER, which takes into account Total Amount Staked and Amount of Staked Days. Essentially, the protocol puts users into different categories: Tiny, Common, Huge. It resembles the approach by DEGO Finance on Ethereum, a design that ensures a whale farmer does not eat up a lot of the pool’s share of rewards.

Additionally, 10% of every user’s rewards go into the protocol’s dividend pool which will be distributed to NAR holders. In this way, there is another incentive for holding NAR tokens long term and not immediately dumping them.

Looking to the future

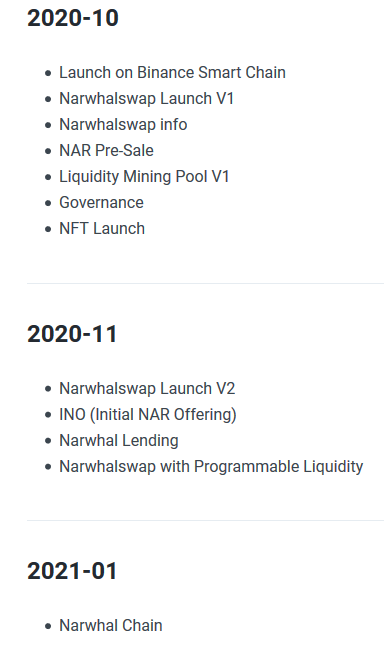

The idea is to promote building a sustainable ecosystem because the team knows there are still not that many projects building on Binance Smart Chain. With this model, Narwhalswap will still be a viable liquidity mining platform to assist projects launching on BSC further down the line.

Additionally there are a lot of upcoming releases on their roadmap such as NFT mining and programmable DeFi liquidity. If you believe DeFi on BSC will be massive in the future, then being an early adopter of NAR today could be a great move!