What is PRIA? Ultra-deflationary Tokenomics

PRIA is an Ethereum token that takes a gamified approach to explore how far we can take an ultra-deflationary monetary policy for digital assets. Here we will take a look at what is PRIA token and the key rules of its tokenomics to understand the game.

What is PRIA Token?

Launched by DeFi Labs, the PRIA project takes onboard innovative decentralized finance (DeFi) ideas from elastic supply assets to incentivize token holders’ continuous market participation. It works like the following on every transaction: 1.25% is burned, 0.85% goes to the airdrop wallet, and 0.5% goes to the developer. Every 200 transactions the airdrop amount will distribute automatically to everyone who qualifies. You can qualify for the airdrop if you make a trade or transfer of 0.25% of the balance of the airdrop wallet. There are also restrictions in place to force market participants such as the airdrop wallet cannot exceed 5% and the developer wallet cannot exceed 1.5% of the total supply.

Minting and burning

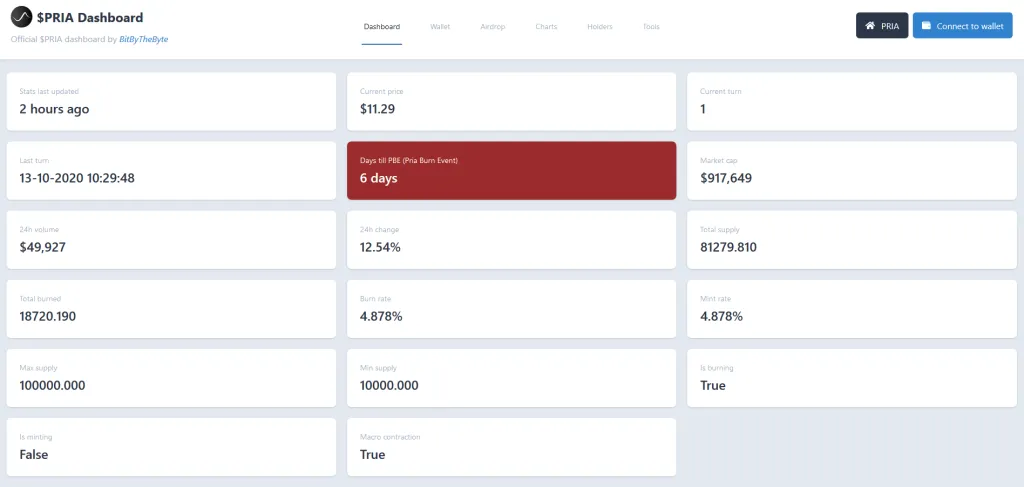

The next thing you need to understand about PRIA is that it never follows an inflationary monetary policy, however, it will go through turns of minting instead of burning. During Turn 1, the maximum supply is set at 100,000 PRIA and the minimum supply is 10,000 PRIA. Once the token burns down to its minimum supply then that marks the end of turn one. At this point, PRIA does the reverse and will mint tokens on every transaction towards its maximum supply. However, at the end of a turn depending on the direction, either the maximum and minimum supply is halved.

For example, when PRIA enters Turn 2, a turn of expansion, the maximum supply is 50,000 PRIA. And once the token hits the new limit, Turn 3 would start as a turn of contraction (burning) again, but now the minimum supply is 5,000 PRIA. And so forth! All the way to 1.2 PRIA.

Inactivity Burn

In the past, we have seen immense hype around deflationary assets. However, once that hype passes then the burn rate doesn’t keep up to drive the price up. Especially, if the team doesn’t have a strong marketing presence or community behind it. PRIA solves this by using an inactivity burn mechanism to enforce its ultra-deflationary policy. For example, if you don’t make a trade after 35 days then you will permanently lose 25% of your tokens. After 60 days, you could lose all of your tokens! Even the developer wallet faces this mechanism, meaning everyone is on the same level. Tokens in contracts, such as the Uniswap trade contract can also be burned due to inactivity (zero trades). However, there is a longer period before this kicks in so its unlikely to ever happen.

Now you know all the key rules of PRIA you should be ready to play the game. Good luck!