What is Shell Protocol? Flexible Liquidity Pools

Shell Protocol is a new automated market maker (AMM), which currently features an innovative flexible type of stablecoin liquidity pool. The protocol takes advantage of the best features found in other DeFi protocols such as Curve, Balancer, mStable, and Mooniswap. However, in the future, the platform plans to support BTC and ETH pools, along with a liquidity mining program to farm its governance token SHELL. Here we will take a look at what is Shell Protocol and its upcoming SHELL token.

Is Shell Protocol another DeFi clone?

I can see what you’re thinking: another DEX/Uniswap/Curve/DeFi clone looking to take advantage of the market’s fascination with farming tokens! Well, fear not, Shell Protocol has several features that set it apart from other AMM protocols:

- Deep stablecoin liquidity: like Curve, the protocol can support large stablecoin to stablecoin trades with low slippage.

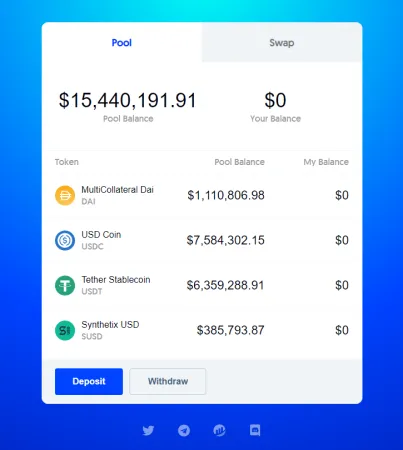

- Reserve weights: following Balancer, liquidity pools in Shell can have weights. For example, the stablecoin launch pool is 30% DAI, 30% USDC, 30% USDT and 10% SUSD.

- Protections against broken pegs: Shell pools also have a minimum and maximum allocation for each stablecoin. This is a feature similar to mStable which ensures if an asset loses its peg, liquidity providers will not lose all their deposits.

- Dynamic fees: Looking at Mooniswap’s innovative approach to redistributing profits from arbitrage traders to liquidity providers, pools on Shell will charge a dynamic fee. For example, a higher trading fee will be set if a stablecoin deviates from its peg.

- Interoperability with aTokens and cTokens: excitingly Shell Protocol makes no difference if the stablecoin is deposited in an Aave or Compound lending pool. Meaning you can trade aUSDC or cDAI directly without needing to first withdraw. Much like using Furucombo users will be able to save on gas fees!

Flexible Liquidity Pools

The best part is the five features above can change post-deployment. No need to redeploy smart contracts or schedule protocol upgrades which can cause token holders to get nervous. Shell pools can dynamically adapt to new market conditions or use cases.

You Might Also Like:

- What is Pickle Finance? Bringing Stability to DeFi

- Value Liquid will feature Flexible Farming

- Double Farming with SashimiSwap

Did a stablecoin lose its peg completely? Did a project in your DeFi index pool fail? Remove it and replace it with a different stablecoin/token! Overall, the increased flexibility will create safer pools for liquidity providers.

🐚🐚🐚🐚🐚🐚🐚🐚🐚🐚

— 1inch Network (@1inch) October 5, 2020

🐚SHELL RELEASE!🐚🐚🐚

🐚🐚🐚🐚🐚🐚🐚🐚🐚🐚

We are thrilled to announce @ShellProtocol integration in #1inch! New stable token liquidity protocol! 🚀🦄🌈#DeFi pic.twitter.com/ZhRMdacvYp

Lastly, the team is not rushing out the SHELL farming, which is a strong indication the project is aiming for long term sustainability with their tokenomics. Their announcement post mentions potential retroactive rewards, 1inch has already taken notice, perhaps you should too?