Risk Management aka Surviving the Trading Marathon

Hello there, ah it seems you've opened that door of leverage trading Bitcoin. Well, you can't close it now, the allure is too overpowering. Perhaps, you caught a perfect x20 long on the sweet nectar of an illiquid altcoin and saw your PNL print. Your portfolio did a 2x overnight. Of course, the next day, you roundtripped an oversized trade. Woke up to a liquidation email. Sound familiar?

Don't lie you've probably blown up an account or two before you ended up here. But that's okay, we've all been there. The important thing on your trading journey is not to repeat the same mistakes. Keep a trade journal, identify mistakes, and eliminate them. If you're making the same errors on repeat, then leverage trading may not be for you - simple as. And there is no shame in that, just have to admit it. Here we're going to look at some basics of position sizing and leverage for crypto trading.

Capital preservation first, capital growth second.

Don't be too eager to make money, yes you may have been brought to crypto because of the volatility found in this asset class. You may have created your exchange account because your friend told you about his/her crazy gains. But there is no taking advantage of volatility if you destroy your portfolio on day 1.

Essentially, if you do not have any gunpowder then you can't participate so there will be no life-changing gains. That is why trading is a marathon, you don't even need to be first - you just need to be running in the race (Survive!).

Printing Every Day?

Lots of new traders seem to think they will/should be making thousands per day. This type of thinking will quickly destroy your account. If you think only about your PNL then you won't develop as a trader. You will end up taking bad trades simply because there are $$$ signs in your eyes. And I repeat once more: surviving is the key to winning in the trading world. The main reason why? There is always another trade. By respecting your risk management strategy, you will be there to capitalize on them.

It's a discipline. More akin to a martial art. If you want to get ahead you need to put in the hours, every single day. You have to follow and respect your system, otherwise, you're better off going to gamble in a casino. Going all-in oversized on a leveraged trade simply because more money bro is how you give your money straight to CZ or SBF.

So what is risk management?

Investment decisions are always going to be uncertain. What we know for certain is price goes up or price goes down. The reason we use risk management is that if we get it wrong: we can make another trade. I am never all in on a position, and rarely ever get stopped out (more on that later).

For a smaller portfolio, it will be a challenge to stay cautious and be risk averse. Don't get me wrong, I understand the allure of one life-changing trade is strong. But the bottom line is you will be more profitable over the long term by risking small amounts of your portfolio. While making a 30% return on one trade may send you into leaps of joy. Equally a trade that sends your portfolio into a 30% drawdown will probably give your decision-making an emotional jolt.

Appetite for risk

First up you will need to decide how much you're willing to lose per trade. I can't decide for you, everyone has a different appetite for risk. From experience, most traders set this between 1 to 3% per trade. Essentially, this means that if the price moves to my hard stop (invalidation for my trade) then the maximum I can lose is 1% of my capital. This is what works best for me, but it might not fit your trading style.

Also with experience, you will gain higher conviction on certain trade setups. And this is where you might be comfortable increasing your risk. Another tip is having rules for different types of trades, perhaps on a scalp you risk 1% but for a swing it's 2%. One rule I recommend implementing into your system is a maximum loss per day. This will save you from doing something stupid such as emotional or revenge trading: I will make it all back this trade. For example, you could set your maximum loss for the day at 4%. Meaning if you lose more than that then you have to have a night's sleep before trading again.

Position Size?

Here we're going to do a basic calculation for position sizing. First up before entering a trade, you should know where you're going to place your stop. If you don't have an invalidation level for your trade, then you can't correctly calculate your position size. And if you don't have an invalidation level, then you're not trading you're straight up gambling.

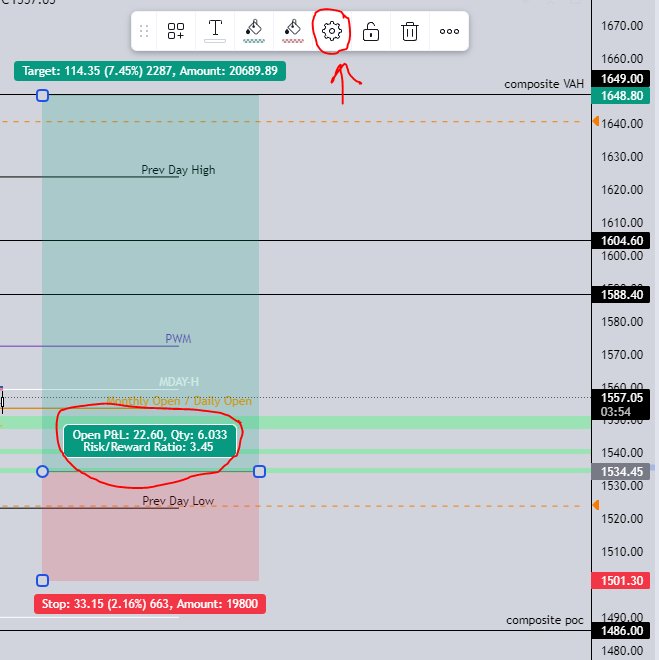

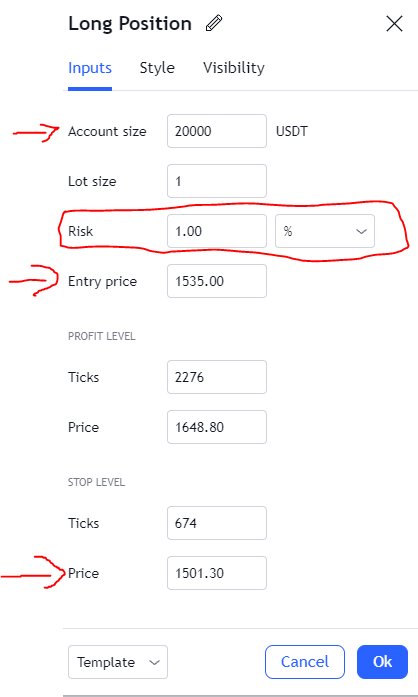

- Account size: $20,000

- Risk: 1%

- Risk Amount: 1% of $20,000 = $20,000 x 0.01 = $200

- Entry price: 1534.45

- Stop: 1501.30

- Invalidation point (distance to stop): a decrease of $33.15 so roughly a 2.16% decrease.

What is my position size? Position Size = Risk Amount/Invalidation point = $200 / $33.15 = 6.033 so your position size would be 6 ETH. If you prefer to work in USD then you need to divide by the percentage, $200 / 0.0216 = $9259.

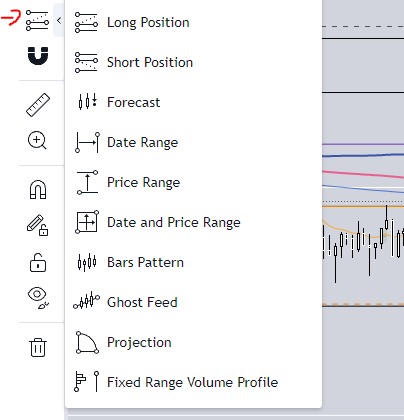

And if you're terrible at math or setting up a google sheets, simply use the long or short tool in Tradingview to calculate your position size automatically. Remember to set up the risk % and account size in the settings section.

You don't HAVE to be full sized

Now you know how to calculate your position size correctly. Another way traders manage their risk is by adapting their position size to the trade or market conditions. What does that mean? For example, maybe you've planned a swing BTC short at 30k but notice momentum slowing down heavily at 28k with nasty rejections on the lower timeframe. In that case, you could start to scale into your position. If the price does continue upwards you can either: A) cut the position with a small loss to enter higher or B) add size to the position. Or maybe BTC looks like it's going to pump big but American equities don't look so good, so you want to minimize risk in case of a correlation dump. The bottom line is if you're feeling nervous in a trade it's most likely because you're oversized. And therefore, it's a bad trade.

Other reasons could be: scalping meme coins, wanting to sleep easy, this altcoin has terrible liquidity, or maybe you went AFK and missed the perfect entry. Just food for thought, turn it into your own rules. What I am getting at is be ready to adapt while sticking to your risk management strategy.

Leverage has nothing to do with position size

I put that in big font, so be sure to re-read it a few times. Checking the comments on popular crypto trader accounts, or streams, I see the same question over and over again. What leverage are you using? Yet leverage has nothing to do with position size. Leverage dictates how much margin you need to provide to open the position. It doesn't change the calculation for position size in any way. Note how Tradingview doesn't ask you about leverage when you use their long or short tool.

Asking what leverage another trader uses is a pointless question, they may trade a completely different style than yourself. High leverage is mostly used for marketing purposes from exchanges.

Don't get stopped

By this I mean: actively managing your position. Especially if your trade is planned as a scalp or an intraday swing. Things can change market conditions quickly in crypto: equities might sell off and cause a small nuke. Or a project might get hacked and mess up you're technical analysis completely. So if you're full sized in the trade and the price is getting away from you, then what is the point of holding to max invalidation? You might see clear signs on the lower timeframes that you've got it wrong. So escape and live another day! Manually cutting trades before stops is perfectly normal. You can always re-enter the trade lower down, or if it does bounce and reclaim key levels from your analysis.

Conclusion

Let me say that traders have different risk strategies, they adapt them to what works for them. And that is fine! Maybe you have a much greater appetite for risk. Maybe you like to scale into positions slowly with wide invalidation.

Maybe you like to smash market buy and cut immediately if you don't get the breakout. There is no one risk strategy to rule them all, the important part is having one in place and sticking to it. As I've said earlier the key to being profitable long-term is staying in the crypto trading marathon, that's what risk management gives you. Hopefully, this article has set you on the correct path for forming your own trading & risk rules.