What is Cover Protocol? COVER Token Explained

Cover Protocol provides decentralized insurance for Ethereum smart contracts, powered by the platform’s COVER token. Uniquely, the protocol enables risk coverage in the form of a peer to peer marketplace. Meaning the pricing of protection is decided by the market and not one entity. Here we take a look at what is Cover Protocol and explain the use cases for COVER token.

What is Cover Protocol?

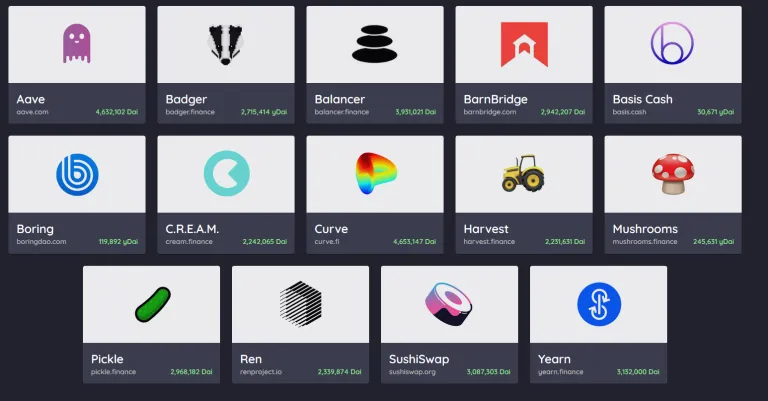

Cover Protocol enables users to protect themselves against security incidents that can happen from using decentralized finance (DeFi) protocols. A lot of the smart contracts and oracles that power DeFi products remain experimental technology. Even if they have gone through security audits. This means there is always a risk you could lose funds. Cover Protocol provides a decentralized way to buy risk coverage for using yield farming platforms or any form of interaction with smart contracts.

The platform uses a governance token COVER, which lives on Ethereum with the following use cases:

- Shield Mining: this is a form of farming. As a result, users earn rewards in COVER tokens for providing liquidity to the protocol.

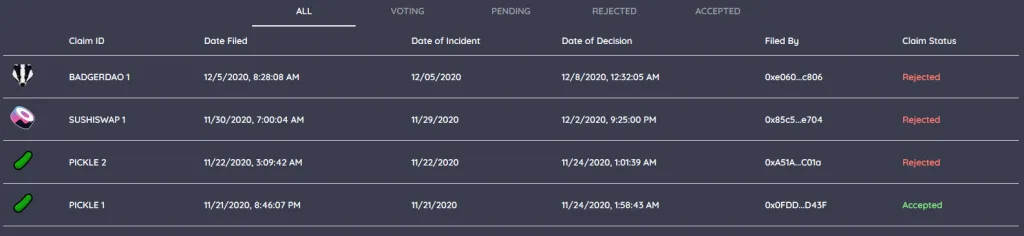

- Claim Management: token holders ensure the protocol runs smoothly by validating or invalidating claims for coverage protection payouts.

- Governance: the future of the protocol will be driven by community proposals, meaning COVER provides holders with voting rights.

When a users deposits collateral into the protocol’s Cover smart contracts, they will receive Fungible Cover tokens in return.

Fungible Cover Tokens

Each Cover contract will specify what DeFi protocol/smart contract the protection is covering. It will also designate details such as collateral type, the amount of the deposit, and the expiration date of the coverage. Fungible cover tokens exist on a 1:1 basis with their collateral specifications. Meaning if a liquidity provider deposits a unit of collateral (say 100 DAI), they will receive a CLAIM and NOCLAIM token. These two tokens are tradable via decentralized exchange like Uniswap or Balancer as they follow an ERC-20 standard. Meaning they can be sold to Coverage Seekers or Coverage Providers. Essentially, holding a CLAIM token means you can receive the collateral if there is a security incident which the Cover smart contract covers. Whereas, the NOCLAIM token represents the right to the collateral if there is no incident.

To summarize there are three participants in Cover Protocol’s ecosystem:

- Market Makers: providing initial liquidity which creates the fungible cover tokens, they’re holding CLAIM and NOCLAIM tokens.

- Coverage Seekers: hold CLAIM tokens for coverage on their preferred DeFi product.

- Coverage Providers: hold NOCLAIM tokens to bootstrap protocol liquidity and earn rewards if there are no security incidents.

Why build a P2P Coverage Market?

Scalable: Competitors currently provide their coverage depending on the number of funds pooled via staking which means they will hit a limit. Whereas, with Cover Protocol theoretically no coverage ceilings exist given its coverage is independent.

- Another attraction for using the protocol is that it enables users to buy coverage without completing any KYC verification.

Looking to the future… while the use cases of Cover Protocol are easy to grasp when thinking of smart contract risk that comes with DeFi, this is a decentralized platform! This means users can buy coverage on anything, so think beyond smart contracts and crypto. Through the use of oracles to source off-chain data it’s possible for the protocol to power coverage for traditional use cases. Therefore, the future could see coverage for flight cancellations, homeowners, vehicle insurance, and more.