What is DODO? Meet The Proactive Market Maker

DODOEx is a decentralized exchange deployed on Ethereum. It feels much like using Uniswap, however, there are some notable tweaks to achieve more efficient usage of capital. Uniquely, users can provide single asset liquidity and there is no impermanent loss. Team DODO claims that liquidity providers can receive up to 40% APR on their deposits, and that is without factoring in any liquidity mining rewards.

What is DODO?

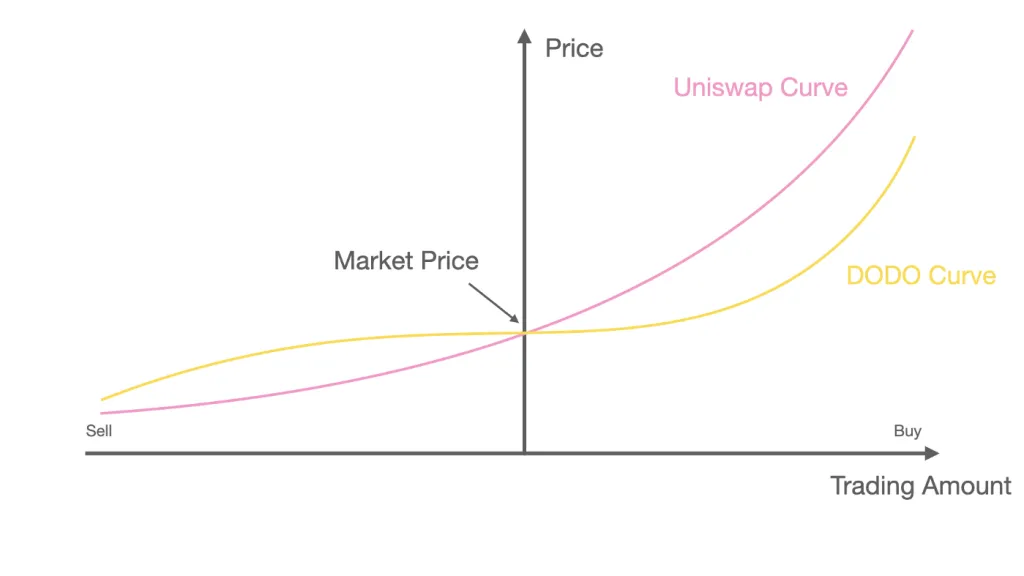

At its core, Dodo is an on-chain liquidity provider that acts much like Uniswap, Mooniswap, or Value Liquid. The key difference is DODO uses an alternative approach to automated market making. Referred to as being a Proactive Market Maker (PMM), DodoEx uses price oracles to copy the behavior of real human traders & market makers.

Essentially, the algorithm checks the prices of assets allocating funds to proactively increase liquidity near the market price. And it rapidly decreases liquidity if it gets further away from the market price. By following a proactive approach to using its liquidity, the protocol makes capital usage more efficient. As a result, you find a high level of liquidity which reacts more like a centralized exchange.

The innovative pricing formula enables liquidity providers to deposit a single asset instead of both crypto assets. When a trade happens, PMM dynamically adjusts the price to attract arbitrage trading to rebalance the liquidity provider’s portfolio. This is an idea to mitigate the dreaded issue of impermanent loss that we find on many AMMs.

How to use DODO exchange?

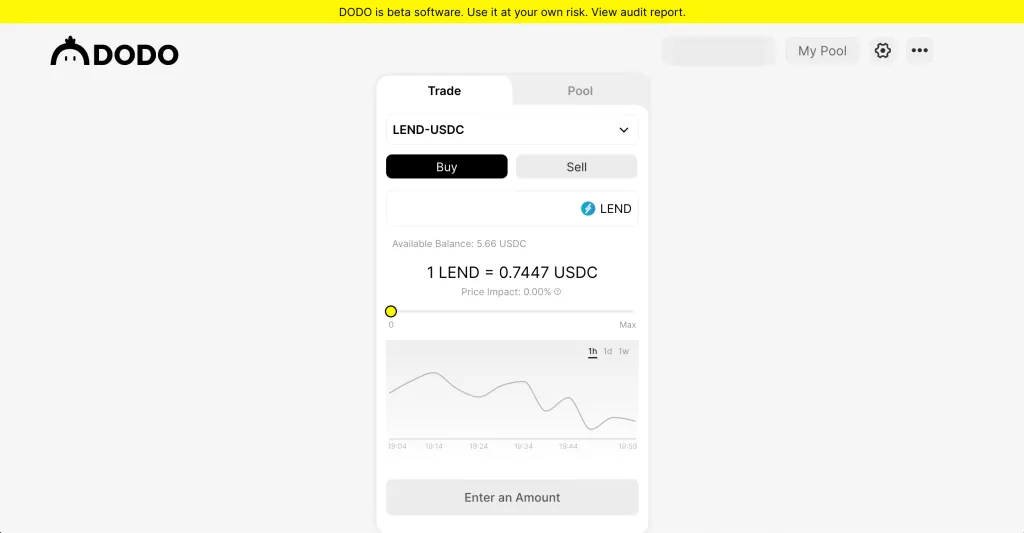

Traders can swap between two tokens by using the DODO Exchange, note you will need to be comfortable using a dApp browser such as MetaMask. One thing to know is that you can’t trade tokens against each other, all pairs are with USDC.

Currently, trading is live for many mainstream tokens such as ETH, WBTC, LEND, SNX or YFI. For liquidity providers, you can use the Pool tab to easily add or remove liquidity via the dashboard – along with claiming any DODO rewards. The DODO protocol is in a beta phase, though it has been audited by PeckShield and Trail of Bits.