What is Reflect Finance? RFI Token Review

Reflect Finance (RFI) is an Ethereum token that aims to innovate yield farming by making it frictionless. The project does this by building yield generation mechanisms into its core smart contract code, instead of relying on other DeFi protocols.

What is Reflect Finance?

RFI token works by applying a transfer fee on each transaction. Every transfer will incur a 1% fee, which is automatically and instantly distributed amongst all token holders. Additionally, the RFI smart contract can block certain addresses from earning yield such as an exchange wallet address or the Uniswap pool. This ensures 100% of the collected fees go straight back to the holders.

The idea is to remove all the friction when dealing with DeFi platforms: no pooling funds, no transactions required to claim rewards, no actions required apart from holding RFI. As a result, users do not have to interact with any external contracts or website interfaces. Yield generation through fees and distribution are hard-coded into the smart contract. Consequently, security risks are lower: if Ethereum exists, so does RFI token.

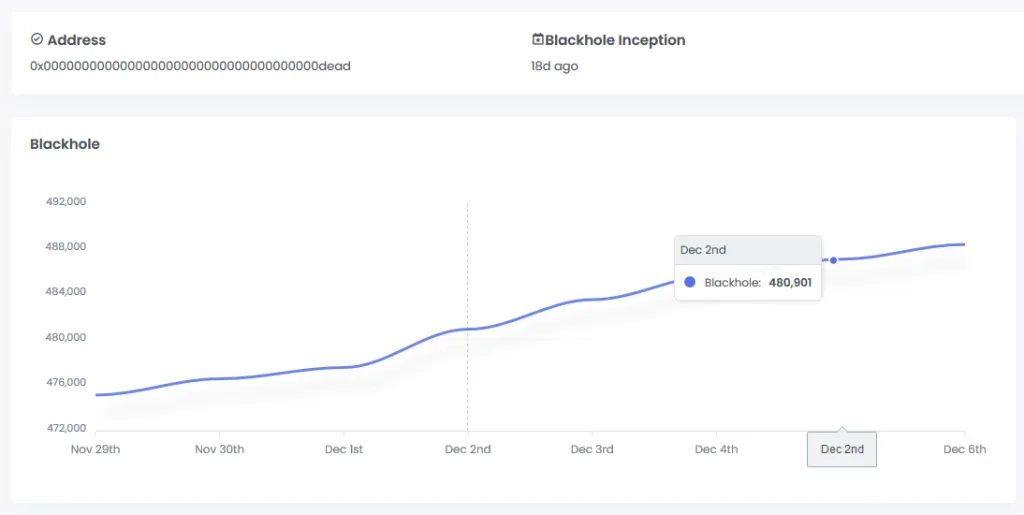

Lastly, the team set up a burn address where 445k tokens were sent. Any tokens that go into this address are permanently taken out of circulation, hence the name: The Blackhole. However, this address will earn fees with each transaction, it will get larger over time. Therefore, Reflect Finance (RFI) is also a deflationary token by design.

RFI Token Review

With a fixed total supply of 10M, there are no fears of a whale farmer market dumping freshly minted reward tokens. All the yield you earn comes from the transfer fees, meaning the tokenomics are sustainable and not inflationary. Furthermore, the percentage of the total supply you own will continuously increase. As a result, you can hold and earn yield autonomously.

Plus Reflect Finance went live with a fair launch, with no ICO, pre-sale, or fundraising. The team allocated 95% of the total supply into the initial Uniswap pool. And the remaining 5% was distributed via a liquidity program via Flow Protocol. There are no community treasury funds that could be hacked or rug pulled!

Just another deflationary token?

The short answer is no. While RFI token does have a deflationary mechanism in the form of the blackhole address, don’t pass it over for another burning token. The true innovation here is the token’s in-built ability to track the fees earned by each address, even when RFI is pooled in a smart contract. Because this can lead to scenarios of double yield generation.

Staking: imagine a DeFi lending platform such as CREAM enables support for RFI. You can now stake RFI in the protocol to earn interest on your deposit. Given all the tracking is on-chain, the protocol can determine the number of fees earned during your staking period and easily distribute them to you when you withdraw.

- Note from our understanding, this is not an automatic feature. Meaning developers do have to code their smart contract to use RFI’s new methods.

Looking to the future… Right now you can stake via gysr to earn CBET tokens, a partnership with ZZZ Finance for yield farming, a new lending platform Yield (YLD) is launching exclusively with a RFI/YLD pair, and there is an upcoming casino. To summarize, the adoption that will drive volume is happening!