What is Truebit? TRU Token Review

Truebit protocol enables any smart contract capable blockchain to securely perform huge computations in standard programming languages quickly with lower gas costs. Here we will look at what problems Truebit Protocol aims to solve, review TRU token, and provide thoughts on the project’s future.

What is Truebit?

Currently, the smart contracts that power DeFi platforms perform small computations such as yield farming calculations quickly and correctly. However, larger computational tasks such as machine learning, facial recognition, or big data are not feasible and cause security risks for blockchains due to the verifier’s dilemma.

- Verifier’s Dilemma: refers to the lack of incentives a miner has for verifying and storing records of new transactions in consensus protocols (can apply to both PoW and PoS networks). Because the incentive is block rewards, a miner may choose to allocate more resources to block production and not worry about having a fully verified node. The result is a minimal amount of nodes storing the full blockchain history, undermining the security of the whole network.

Therefore, the Truebit protocol is an enhancement or scalability plugin for builders. Essentially, it does this by taking power-intensive computational tasks off-chain, where they can be dealt with by an optimal programming language. And then only submits the outcome to the blockchain. Meaning, significantly lower gas fees and faster transaction times.

Lastly, the beauty of the protocol is that any smart contract can issue a task to be solved off-chain allowing the architecture to remain trustless.

TRU Tokenomics

Now you may think: if the tasks are going OFF-CHAIN, how can the verification remain secure? The quick answer is that Truebit is an oracle (like Chainlink or Band Protocol) and a scalability solution in one.

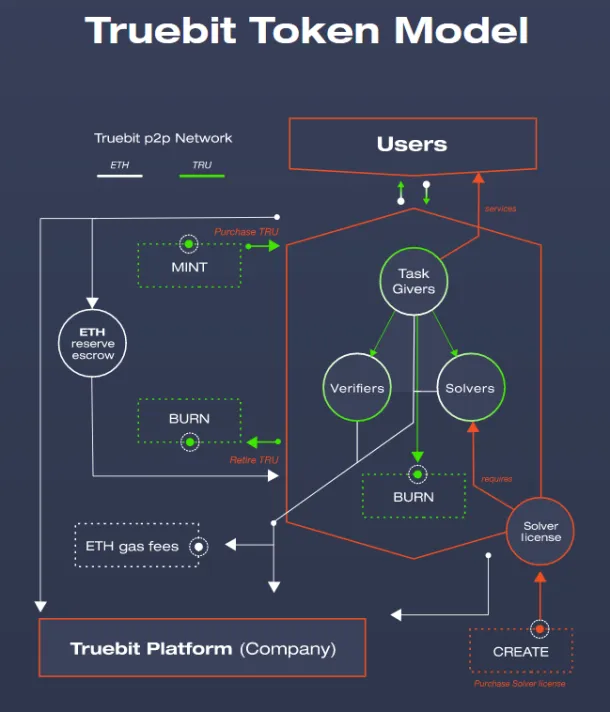

Essentially, Solvers and Verifiers receive rewards (in TRU) for completing tasks. So instead of relying on cryptographic proofs for correctness, which would be slower, the protocol creates a quasi-“Verification Game”. Its built on two layers, where anyone can challenge solutions through consensus. And ecosystem actors are incentivized to participate given the remuneration in TRU tokens.

Main Token Model Features

- Minting: TRU uses a bonding curve that mints new tokens as demand increases, it’s a design choice to promote stable price growth and reduce huge price swings by early whale activity.

- Burns: In the same process, when people sell TRU the bonding curve will destroy tokens.

- Arbitrage: The automatic minting and burning will only happen when people buy/sell via Truebit-OS (using the bonding curve), meaning trading on open markets (Uniswap) will create arbitrage opportunities.

- Usage: TRU is also the method of payment by Task Givers, and a portion is burned. As a result, heavy adoption will pressure demand by reducing the circulating supply. Furthermore, this will increase exponentially as the protocol is deployed to more mainnets such as Tron, Nervos, or Ocean.

Looking to the future

- One thing to note is TrueBit didn’t appear out of nowhere. This is not a team looking to capitalize on Venture Capitalist’s loose investing due to 2021’s bullish market conditions. Founded in 2017, this is a protocol that’s been under development for 4 years. And given the tech’s use cases is a possible multi-billion dollar market cap project (just look at Skale or Loopring). Furthermore, I suspect we will see heavy pushing from DeFi builders to adopt TrueBit as a preferred scalability solution. Because the protocol has existing links to the wider Ethereum team.

If you asked me what my main worry re PoS is, I would say either financial centralization risk arising from either stake pooling being too effective or....

— vitalik.eth (@VitalikButerin) September 30, 2018

For example, the whitepaper acknowledges suggestions from Vitalik Buterin and the creator of Solidity (the main smart contract language), Christian Reitwiessner, co-authored the paper with TRU’s founder Jason Teutsch.

TrueBit looks like a natural solution for scaling computation on Ethereum, despite the '96 throwback site: https://t.co/WcETZ48U9B

— Fred Ehrsam (@FEhrsam) April 13, 2017

Coinbase: Another plus is TRU’s strong links to some heavyweights in the Coinbase world, with one of the co-founder’s Fred Ehrsam being an investor. Additionally, Polychain Ventures is a financial backer which is led by Olaf Carlson-Wee (an early CB employee). Important as though they may no longer work there, they do hold Coinbase stock. Meaning Truebit’s TRU token could very easily be a future listing on Coinbase Pro.

- And let’s not forget that Polychain has a great track record for early investment: LUNA, XTZ, MKR, and COMP.

What about Scaling Wars?

Everywhere we look we see teams embrace Layer2 scaling tech because solving Ethereum’s high network fees and slow transaction times is crucial for attracting more users. Matic, Loopring, Optimism, Arbitrum, StarkWare, xDaiChain… The list goes on and on!

So you might ask, where does TrueBit fall? The answer is everywhere and anywhere because they’re not direct competitors! Truebit’s tech is about giving DeFi builders a realistic way to handle huge computational tasks; it can co-exist with Layer2 infrastructure. Meaning there is no fear of Truebit or TRU becoming obsolete, this protocol is here to stay.