Bancor V2.1 Eliminates Impermanent Loss

Bancor, a DeFi powered Automated Market Maker (AMM), announced impermanent loss will be eliminated with its v2.1 upgrade. Along with providing single-sided exposure via an elastic BNT supply. Additionally, the upgrade will launch Bancor’s new governance token: vBNT.

Bancor is eliminating Impermanent Loss

In the new model, liquidity providers earn liquidity protection over time along with trading fees from the token swaps. The idea is to make being a long term liquidity provider on Bancor more attractive. Currently, decentralized liquidity protocols are facing an ever-growing amount of vampire attacks from new innovative platforms or even just exact clones. Bancor’s new approach aims to provide a sustainable protocol that remains profitable long term. Meaning that users can finally feel the DeFi promise of passive market making rewards.

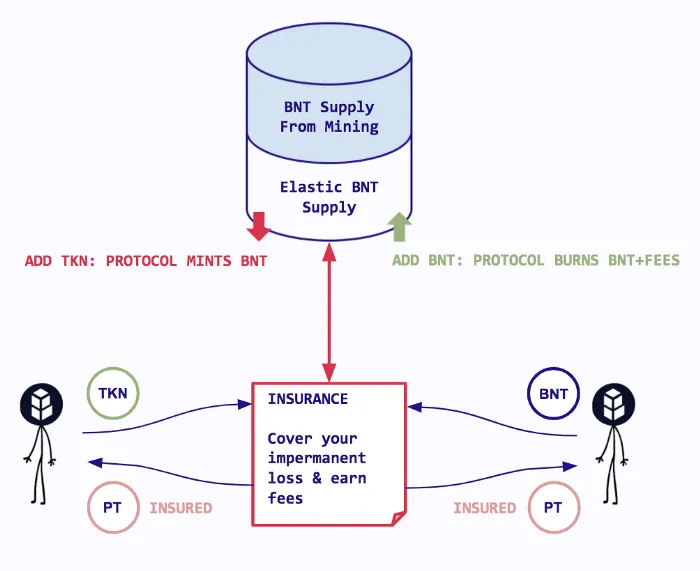

Bancor is changing its tokenomics with the v2.1 upgrade to introduce an elastic supply for BNT. It works by minting BNT tokens when a user deposits assets into a protected pool. Essentially, the counterpart asset in every pool in BNT. To summarize, the protocol is co-investing in the pool with the liquidity provider which it uses to cover the cost of impairment loss.

Bancor governance token is live

Users will also be able to earn rewards in the form of vBNT, by staking in a protected pool. Currently, there are over 60 ERC20 tokens in the protocol’s whitelist. As it stands, given the big change in tokenomics the upgrade to v2.1 is waiting for community approval. However, given the design should increase the ROI of liquidity providers it seems certain the community will vote it through.

The puzzle of solving impermanent loss for good is being tackled by various AMM protocols. All with their unique approach to the problem, however, most require a user to take on exposure to additional assets. Because you nearly always need to deposit two assets into the pool. With Bancor’s fresh design enabling single-sided exposure along with impermanent loss protection, it will make them stand out from the crowd. Expect growth!