bZx Protocol is back with BZRX Yield Farming

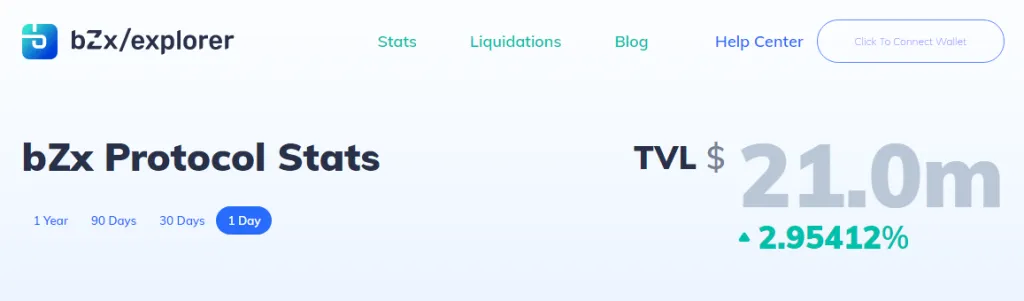

It’s just been a week since bZx Protocol announced their re-launch, and they have already smashed through previous all-time high. There is now over $20M worth of assets locked up in the protocol, which shows the community trusts their relaunch. The decision to pause all products to focus on audits and smart contract security was a tough one. However, it appears to have paid off heavily. As the industry is plagued by DeFi scams, the community will migrate back to known players such as bZx or Aave.

What is bZx Protocol?

At its core bZx is a decentralized lending and margin protocol, offering two main products:

- Torque – fixed-rate loan backed by crypto collateral.

- Fulcrum – tokenized lending and margin trading.

Now, these products have not been changed since their initial launch, though smart contracts have been audited heavily. With bZx 2.0, the front-end has been completely revamped to streamline the onboarding process. Along with a range of new features such as flash loans, collateral management, and gas optimization.

Understanding the value… bZx can provide DeFi participants a trading experience more in line with the fluid margin trading found on a centralized exchange. This is because leveraged trading and lending have been combined into one protocol. Furthermore, the protocol has an inbuilt rebates model where 50% of paid fees are refunded in BZRX token.

What is BZRX token?

So far the re-launch has been going perfectly, no doubt due to the new DeFi tokenomics of BZRX token. The reworked token, BZRX, is a governance token and also used for rewards to create a sustainable yield farming experience. Stakers can earn fees from bZx’s ecosystem which can be cashed out in DAI, USDC, ETH, or any other supported ERC20 token.

Entering Yield Farming… another great choice by the team is that stakers can choose between staking BZRX token directly or a 80/20 BZRX-ETH Balancer pool token. This means there is now an extra incentive for providing BZRX on Balancer liquidity pools. As stakers can also receive BAL governance tokens.

What about the future?

With Torque and Fulcrum, bZx was one of the first movers into the DeFi lending space. They have been able to come back successfully after the setbacks of being hacked, with an immense focus on security and audits. In this current landscape, where DeFi enthusiasts are starting to grow weary of the millions of food-themed copy paste protocols, a team with proper security audits will stand out.

When DeFi users are chasing down the best yields for their assets, the differentiator could be that bZx has higher security. Furthermore, earning BZRX tokens in the form of rebates just for using the protocol is very attractive. Will bZx end up toppling the big dogs such as MakerDAO or Aave? We can’t know the future, but you should be watching them closely.