What is SnowSwap? Liquidity for Yearn USD Vaults

SnowSwap is a new decentralized exchange for swapping yield bearing stablecoins. Specifically, built for yield bearing Yearn Finance assets. The aim is to eliminate steps from swapping stablecoins, when users want to swap to a different Yearn DeFi Vault. Instead of having to withdraw and deposit assets again, wasting Eth to high transaction fees. SnowSwap lets you trade between Yearn vaults directly, saving users a lot of headache, cost, and time.

What is SnowSwap?

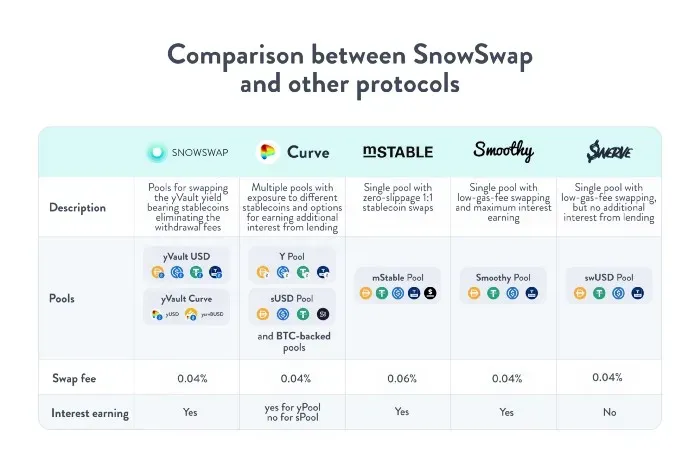

At its core the automated market maker (AMM) is a fork of Curve Finance. It uses Curve’s pooling algorithms but it goes well beyond just being a simple copy and paste fork. SnowSwap is an innovative use case for yield bearing stablecoin assets which aims to solve a real problem.

Despite over 220 million yUSD tokens being minted, there are no liquid markets for the wrapped stablecoins.

You May Also Like:

- Yearn Finance Introduces StableCredit and YFI Price Surges

- Value Liquid will feature Flexible Farming

- Double Farming with SashimiSwap

Exiting vaults can be costly with 0.5% withdrawal fees if their token reserve is low, plus the high gas costs.

Pools for yVault stablecoins… By creating liquidity pools for yUSD tokens, SnowSwap solves these problems. The platform is designed to offer low slippage swaps, meaning that when a user does want to exit a vault they could swap into the vault with a large reserve (to avoid paying withdrawal fees).

- You can also earn additional yield from assets by being a liquidity provider. The trading fees are set at 0.04% per swap, which go to the LPs.

SNOW liquidity mining… And as an additional bonus, users will earn SNOW, the governance token for SnowSwap. The team intends to use SNOW to bootstrap the platform’s overall liquidity. With 80% of the token’s total supply being distributed to LPs, this ecosystem looks ripe for yield farmers.