What is Tulip Protocol? Leverage Yield Farming on Solana

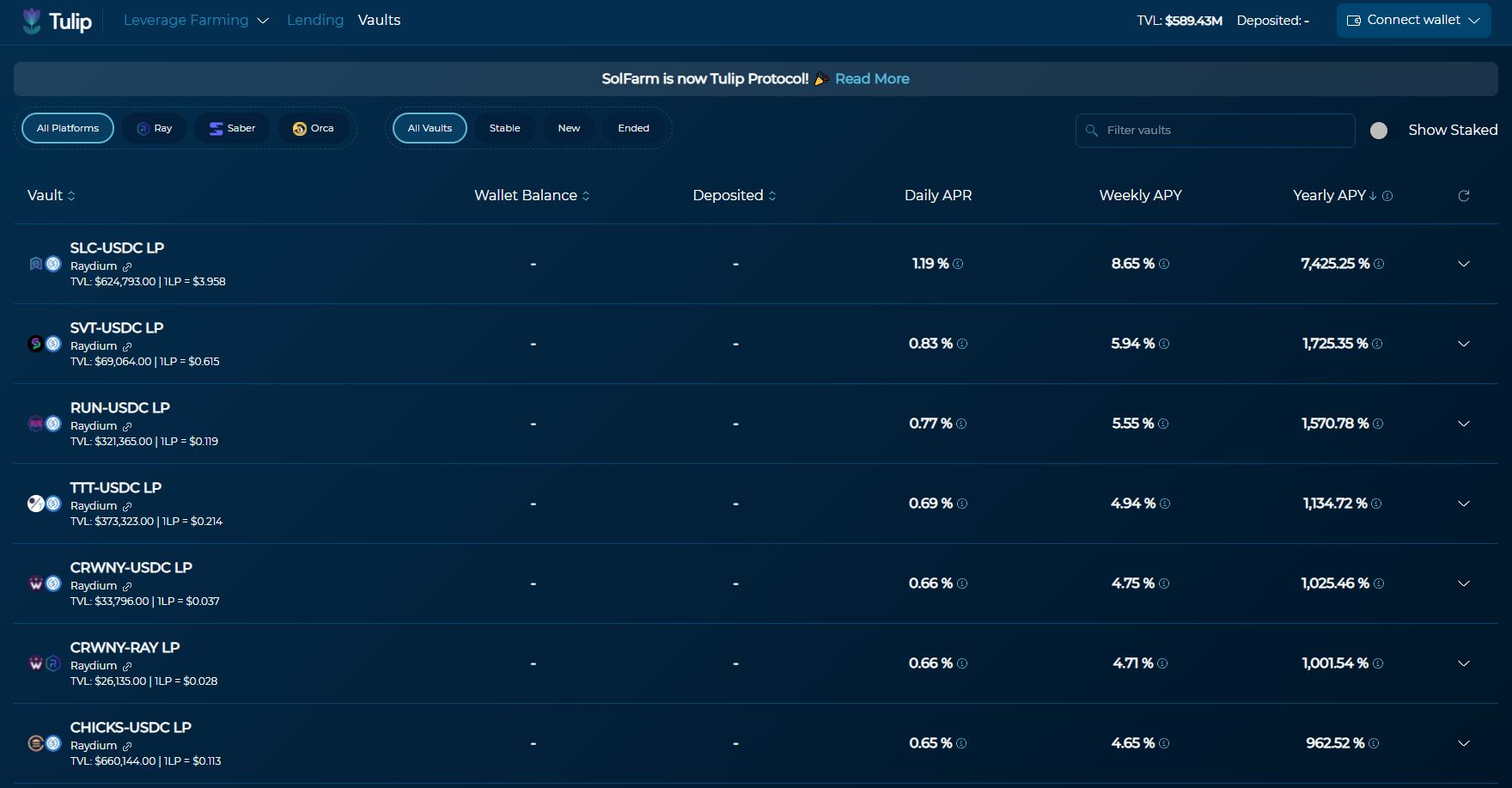

Tulip Protocol is the first yield aggregator platform built on Solana. It features auto compounding vault strategies for popular decentralized exchanges such as Raydium or Orca. This enables users to automatically claim their rewards for providing liquidity and add them to their position. As a result, it's clear that Tulip Protocol takes inspiration from Yearn Finance or Harvest Finance on Ethereum.

🦄🌷1 Billion TVL, that's a lot of $TULIP.

— Tulip Protocol (@TulipProtocol) November 5, 2021

Patience is a virtue when it comes to farming. Thank you for your continued support as we continue to build the best yield aggregation homestead on #Solana!❤️ pic.twitter.com/kQq21030W5

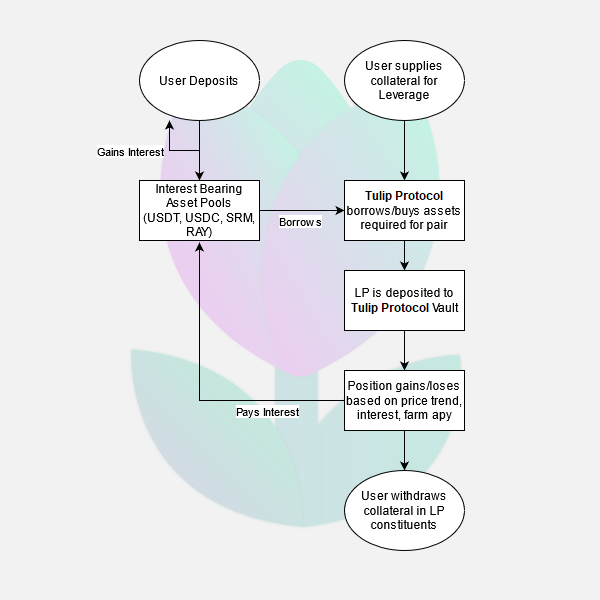

Excitingly, token holders can also lend their tokens (think Venus Protocol) to gain interest and borrow. Which enables users to leverage their yield farming positions to earn higher APYs. Of course, this does open the possibility of your position being liquidated so you need to manage accordingly.

If you've never used any DeFi platforms on Solana before, check out our beginners tutorial where you will learn how to move funds into the ecosystem and set up a wallet.

How does Tulip Protocol work?

Currently, Tulip Protocol (formerly known as SolFarm) supports compounding vaults for Saber, Raydium, and Orca. That is over 40 active vaults, and the team is actively adding more.

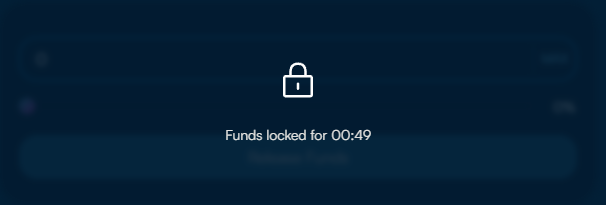

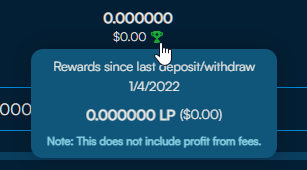

When assets are deposited into the vault then shares are generated. This architecture enables other teams to build on top of Tulip for further DeFi composability or stacking of strategies. However, to avoid anyone trying to game the vault's rewards these shares are locked for 50 minutes. Once the shares are unlocked, it's possible to unstake them.

However, note that for Tulip to track your deposit (and provide real-time updates on your rewards) then you need to keep the deposit locked.

Of course, once shares are unlocked it's possible to retrieve your funds at any time. Simply, use the withdraw function to remove your funds from the vault.

What is Leveraged Yield Farming?

Much like taking a margin position when trading crypto, leveraged yield farming enables you to borrow against collateral to increase your position size. Currently, Tulip supports up to x3 on the platform.

As you can see the projected APY is much more attractive than in the regular vaults. The following diagram from Tulip's documentation outlines how leveraged yield farming works:

Note that this type of farming comes with risk of liquidation. You need to manage your risk and check the dashboard regularly on any leveraged farming position. The required Loan to Value ratio (LTV) is 85%. Any user that does not maintain their LTV value will face liquidation. Its a way for the protocol to ensure lending funds are safe and that lenders will contain to deposit into the platform.

- Recommend reading through Tulip's documentation on their liquidation engine before opening a position.

What is TULIP token?

The platform also has its native governance token TULIP. Currently, the team is waiting for on-chain governance to become available as its being developed by the Solana Foundation. Once released, TULIP token will provide holders with voting power to decide protocol parameters such as:

- Treasury Usage

- Platform Fees

- Protocol Improvements

- Development Vision

- Pool Rewards

TULIP has a total supply of 10,000,00. It's mostly been distributed via liquidity mining, though the first program is over. Look out for future TULIP liquidity programs as this will boost the rewards of the vaults, making it even better for users.

Recommend keeping your eye on the team's updates, as one of the first yield aggregators on Solana they have a competitive advantage over other projects. Note they're also one of the winners of Solana Hackathon 2021, so if they keep shipping updates and new features, they will remain pioneers in the ecosystem.