10 Reasons ALPHA Token will be a DeFi Juggernaut in 2021

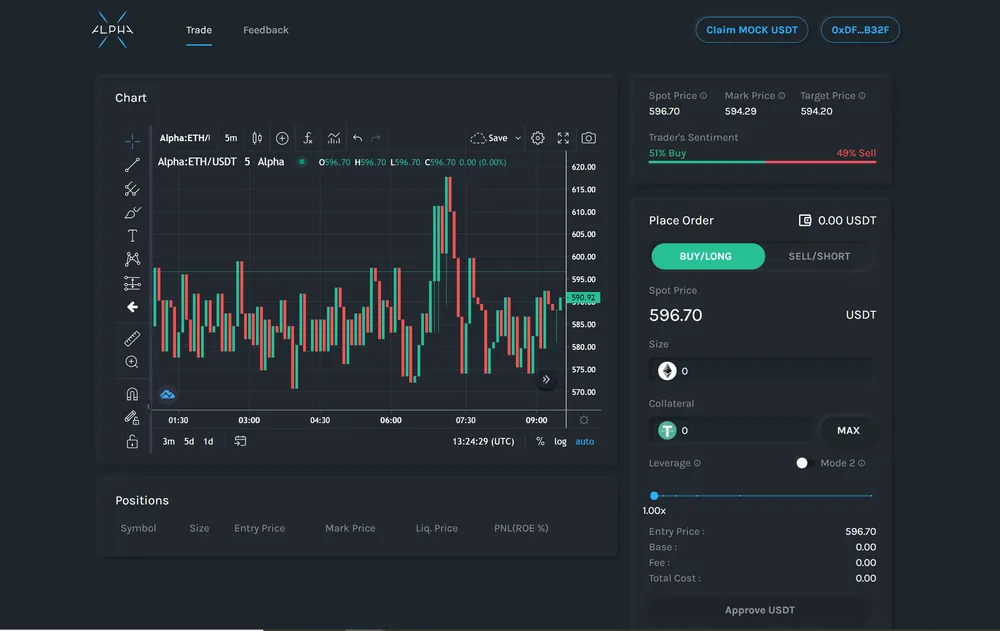

Alpha Finance recently released a sneak peek of their upcoming AlphaX platform. This will be a decentralized, non-orderbook perpetual swap trading market. Traders will be able to take out leveraged long or short positions with no custodial risks or KYC requirements. Much like their Alpha Homora yield farming product, AlphaX is available to everyone and 100% permissionless. Furthermore, the two products will complement each other closely and share ALPHA token for governance purposes. For example, Alpha Homora users can hedge their leveraged farming positions via AlphaX.

It is becoming more apparent that as Alpha Finance releases more products, they will form a juggernaut DeFi suite for trading and yield generation. As a result, ALPHA token holders stand to benefit as the governance token will capture the value of the whole ecosystem. Let’s take a quick recap on upcoming features to both DeFi protocols, along with ALPHA’s recent milestones.

10 Reasons ALPHA Token will be a DeFi Juggernaut in 2021

Here are 10 reasons we believe Alpha Finance is an upcoming juggernaut DeFi ecosystem for 2021. The focus is on the release of AlphaX and Alpha Homora V2, powered by its governance ALPHA token.

AlphaX

- Baked In Funding Rates: to trade a perpetual swap on Binance, for example, users need to understand how funding rates work. Because its how the exchange calculates the interest rate and the premium. AlphaX will bake this into the spot price, so a user’s trading strategy can just be about their entry and exit price.

- Tokenized Positions: opening a long or short position will be tokenized, meaning they will integrate easily into other DeFi protocols (think Alpha Homora). It will be possible to trade, stake, or use them as collateral.

- Dynamic K: Perpetual swap markets can suffer if the slippage is too high or even too low. Given AlphaX follows Uniswap’s non-orderbook model: x*y=k. AlphaX will adjust k algorithmically at a smart contract level, to give traders the best possible experience at all times.

Alpha Homora V2

- More Assets and More Pools: users will be able to lend and borrow against multiple assets, meaning much higher leverage for stablecoin farming. There will also be more pools instead of just Uniswap, such as Curve or Balancer.

- Increased Flexibility: Users will be able to choose if they would like to keep the rewards tokens (think CRV, SUSHI, or BAL) instead of immediately dumping them onto the market. Additionally, users will be able to start farming with their own LP tokens.

- Native flash loan support: this will enable even more interoperability between multiple DeFi protocols. As a result, Alpha Finance’s ecosystem will leverage the success of other protocols.

Ecosystem

- Over 120M TVL: According to defipulse, Alpha Homora ranks 17th by TVL. This will only increase with more product releases.

- Partnerships: Recently the team announced a partnership with SCB10X, the largest commercial bank in Thailand. This will provide expertise from a traditional banking angle, plus a potential easy onboarding route for retail investors.

- Collaboration with AAVE: the integration of Alpha Homora and AAVE provides the best lending rates available on ETH with the interest-bearing ETH (ibETH).

- Nipun: the team’s Lead Blockchain Engineer Nipun Pitimanaaree is 4th in the international mathematics hall of fame. More importantly, he demonstrates a rich understanding of flashloans and their attack vectors. Flashloans have been the downfall to numerous DeFi protocols. As a result, understanding their ins and outs as a developer is crucial.

Summary

With Alpha Homora v2 currently going through an audit from Quanstamp. Along with AlphaX already going through its initial beta testing phase – there is a lot to look forward to in 2021. Of course, we can’t know for certain that these new products will be successful. However, the team appears to be doing everything right to attract users and make onboarding easy. Therefore, there is no reason to think why Alpha Finance cannot carve out a big chunk of the growing DeFi economy. And that will translate into increasing the demand for ALPHA token as we move into 2021!