What is Alpha Homora? Leveraged Yield Farming

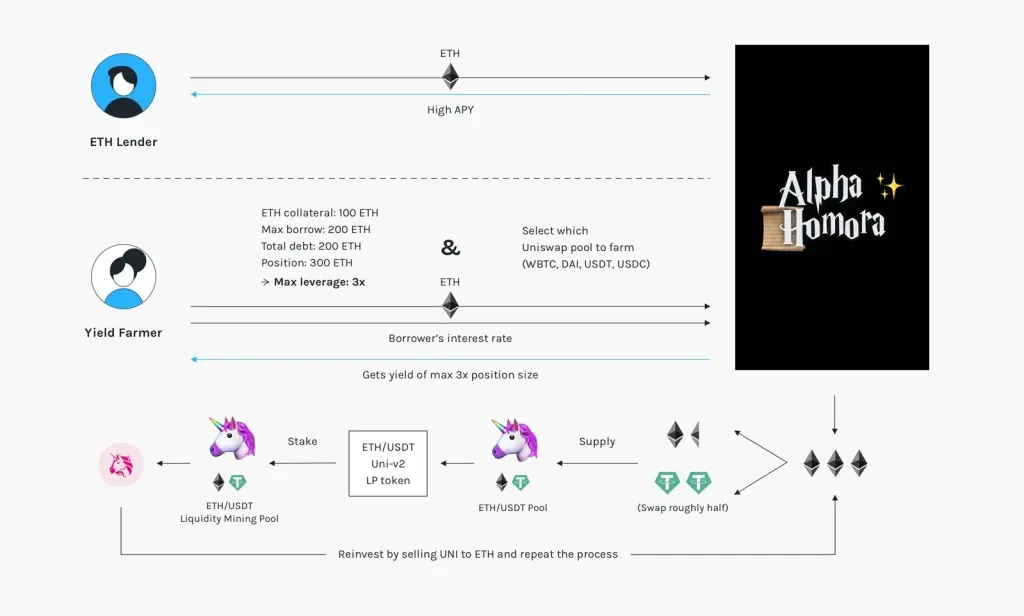

Alpha Finance, a leveraged yield aggregator, now supports popular DeFi tokens such as AAVE or MKR. Alpha Homora makes leveraged yield farming easy, enabling users to borrow ETH to take higher liquidity positions on supported pairs.

What is Alpha Homora?

Alpha Homora is a protocol for leveraging your favourite DeFi farming strategy, the team describes it as a dYdX for yield farming. Essentially, it enables you to provide liquidity to Uniswap pools with up to 2.5x your initial portfolio size. As a result, you can earn more trading fees from the swaps going through the pool. Additionally, your provided liquidity is going to generate more rewards.

Alpha Homora will re-invest all yield farmed tokens into your position every 24 hours, meaning it automatically maximizes your profit. To quickly summarize, the ecosystem features several actors: ETH Lenders, Yield Farmers, Liquidators, and Bounty Hunters.

- Lenders: stake their ETH in the protocol to earn interest, much like via Aave or MakerDAO.

- Yield Farmers: would be the borrowers, who want to farm Uniswap pools with leverage.

- Liquidators: Keep the protocol safe by liquidating positions at risk (bad debt), in doing so they earn 5% of the position value.

- Bounty Hunters: the re-invest feature is not automatic, the function needs to be called. Users who call the function will earn 3% of the total reward.

Why would anyone want to farm with leverage?

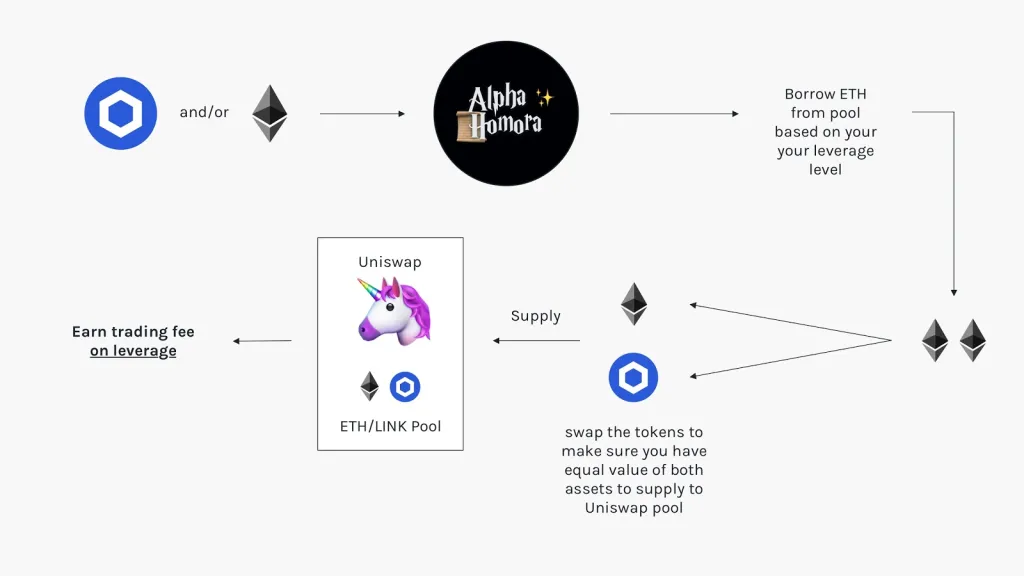

DeFi farming with leverage via Alpha Homora means you’re at risk of being liquidated. If the token or ETH price drops significantly then this could result in the loss of all your assets. Essentially, it is like margin trading but for yield farming so will require much more monitoring than usual. However, if you’re bullish on an asset such as LINK then you could stand to earn more trading fees by borrowing ETH. Here is an example of how it would work for ETH/LINK pool.

Additionally, Alpha Homora adds functionalities to help increase your capital efficiency much like a vault product. For example, you can use the platform to provide liquidity to Uniswap with just one asset without needing the equal amount of ETH. The platform will automatically convert/swap the required amount to ETH so that you can supply the liquidity. Or you can start with ETH and it will automatically buy the amount of tokens required. Furthermore, you can access these features without needing to take any leverage. Magic!