What is DEFLA Protocol? DEFLA Token Review

DEFLA is a new type of elastic supply token on Ethereum that merges economics with game theory. DEFLA Protocol’s design will algorithmically ensure the token’s scarcity increases no matter what market conditions. The outcome is a digital asset that autonomously adapts in a way to increase its value, the team describes DEFLA as a born survivor. Here we will go through what is DEFLA Protocol, and how the team combines popular decentralized finance (DeFi) features with proven game theory economics.

How does DEFLA’s game theory work?

There are two main functions powered by the token’s smart contract code:

- DEFLAtion: If the price of DEFLA drops by 10% within 24 hours, then the rebasing mechanism is triggered. As a result, every wallet’s balance reduces by 1% to increase scarcity and raise the price.

- DEFLAgration: If the price continues dropping by 10% in the same 24 hour period, then the protocol will burn tokens stored in the public vault. Every DEFLAgration permanently destroys 1% of the total supply. The idea is to rapidly increase scarcity and therefore price.

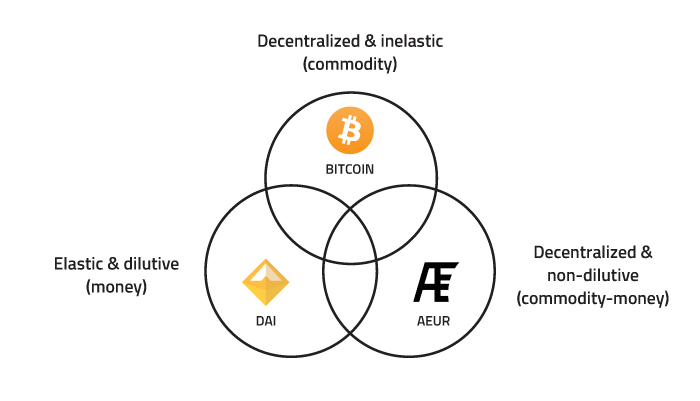

It’s important to note that the team has taken a fair approach with the rebasing mechanism. Many elastic supply tokens will reduce a user’s balance in percentile terms, which by default favors whales. However, DEFLA’s rebases are non-dilutive which keeps everyone on the same level. Meaning that after a balance decrease, a user always holds the same overall percentage of DEFLA’s total supply.

And the third function that ensures the protocol’s game theory economics can be enforced is the vault.

- Vault Supply: The locked vault contains 99% of the token’s total supply (less now as the protocol is live). As a result, a total of 99 DEFLAgrations are possible which would equate to burning 99% of the total supply.

Looking to the future

DEFLA’s presale hit the hard cap within 13 hours, and the team immediately allocated 120 ETH to the WETH/DEFLA Pool on Uniswap. Additionally, 50% of the liquidity is locked meaning DEFLA has a permanent price floor. Initially, the team pledged to allocate 55 ETH to the pool, so this is a big increase. It shows the team believes in their tokenomics, and provides an ideal baseline for the team’s vision of DEFLA to grow!

Rewards for holders: The team has also launched a campaign to reward DEFLA holders with a second token called Algoeuro. AEUR is an elastic supply token that rebases according to the EUR/USD foreign exchange rate. As a result, AEUR should be less volatile than DEFLA. To be eligible you must hold at least 500 DEFLA, full details found here.

- What is great about this first reward program is that token holders do not have to stake or lock up any DEFLA, meaning no extra steps and no expensive network cost (gas fees).

Multichain: Hybridverse Labs is not a newcomer to cryptocurrency, in 2019, the team released the first stablecoin proof of concept on the Zilliqa Blockchain called Hybrid Euro. Future plans include bringing cross-chain integrations with Polkadot and Zilliqa by Q4 2021. Exciting!