What is SYNC Network? NFT Yield Farming

SYNC Network is a DeFi platform that enables users to lock Uniswap liquidity in a tradable non-fungible token (NFT). In return, users earn interest in the form of SYNC tokens through liquidity mining. Essentially, you can think of this as yield farming with NFTs. Here we will look at what is SYNC Network and how SYNC token works within its ecosystem.

NFT Yield Farming

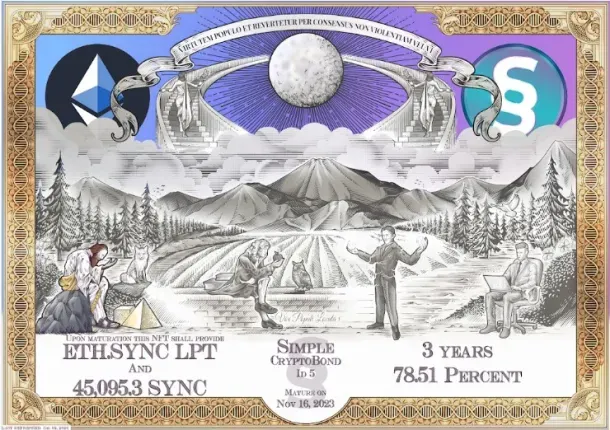

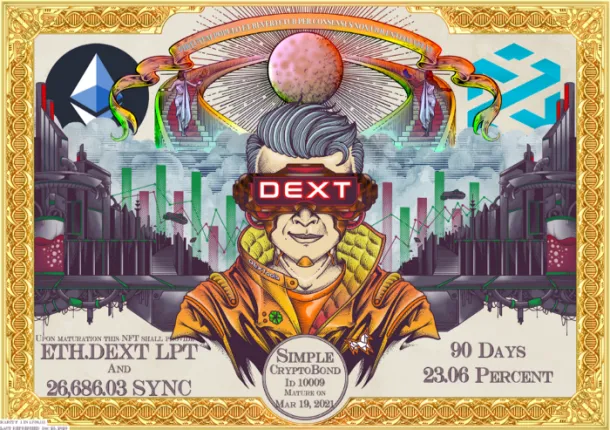

To do this SYNC Network creates a new asset class called CryptoBonds. Which are an NFT which follows the ERC-721 standard meaning they’re 100% tradable on marketplaces such as OpenSea or Rarible. However, CryptoBonds do not only contain the locked Uniswap LP tokens. Users must provide a corresponding amount of SYNC tokens equal to the LP tokens.

As a result, SYNC tokens are continuously being taken out of circulation as users create new bonds. At maturity (the unlock date) then the Cryptobond holder will receive the original SYNC plus all the mining rewards. Of course, the Uniswap LP tokens will also be unlocked. To incentivize long-term locking there is also a dividends option for 1 to 3-year bond lengths. These enable holders to receive their SYNC rewards every quarter.

A key feature to understand is that while the SYNC mining reward rate will change daily, the reward rate is fixed and locked in when you create a CryptoBond. As a result, you can truly plan a long term DeFi farming strategy as you don’t have to worry about APY changing drastically.

Bringing Stability to Liquidity Pools

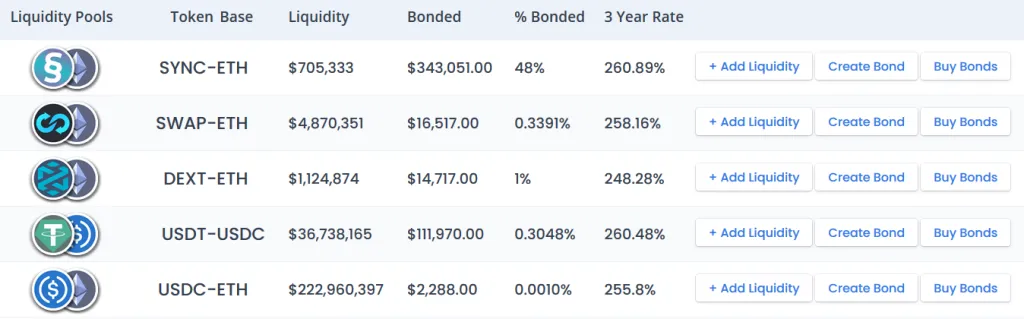

One major problem teams have come across with the rise of yield farming is that liquidity providers have no loyalty. After all, it is only normal that you want to receive the best returns on your funds. The problem is when DeFi whales skip from one platform to another they tend to remove their liquidity and dump their rewards. This leaves the project’s community in a panic and destroys trust. SYNC Networks offers a way to incentive holding liquidity pairs for long periods, giving the industry the stability it needs for further growth.

Zap in: the Bond Builder dashboard is beginner-friendly with one click liquidity adding. Great to see a streamlined process where users do not have to first figure out how to add liquidity to Uniswap. Furthermore, it will automatically calculate the number of SYNC tokens required to create a new bond.

- SYNC is going through a Fair Release Schedule, which uses a pool for distributing a daily amount of tokens. Currently, this can work out much cheaper than buying directly off the market.

Looking to the future: The team is building strong partnerships through their DeFi liquidity locking service called SYNC-LOCK. Current partners include xBTC, DexTools, and TrustSwap – no doubt there will be more to come!