What is Dracula Protocol? One Tool To Farm Everything

Dracula Protocol is a DeFi farming protocol that enables users to capture value from liquidity mining programs on other popular platforms. Team Dracula refers to this as the Victim list, which currently comprises: Uniswap, Pickle, SushiSwap, Value Liquid, and LuaSwap. Essentially, Dracula Protocol unifies all of the yield farms under a single smart contract, accessible via one web interface.

What is Dracula Protocol?

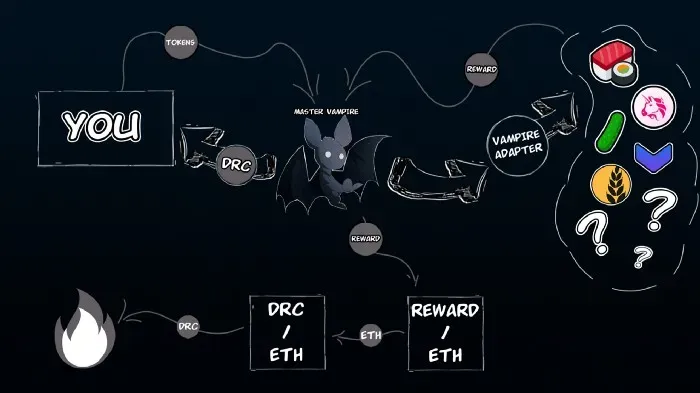

Dracula Protocol aims to provide a yield farming operation that is sustainable long term, bringing stability to the DeFi ecosystem. The team achieves this by providing proxy staking pools that automatically transfer funds into targeted pools through different adapters.

Furthermore, users receive Dracula Tokens (DRC) as rewards for staking in the platform’s pools. The team notes that many farming protocols are at risk of long-term inflation. Thus causing a vicious circle of whale farmers dumping their tokens on retail investors. However, DRC’s tokenomics is deflationary by design to avoid the common over-emission problem.

You May Also Like:

- RottenSwap: Meet Deflationary DeFi Farming

- What is Vampire Protocol? Gamification of a Stablecoin

- Double Farming with SashimiSwap

Additionally, Dracula Protocol mitigates this risk with its unique drain feature. It automatically claims rewards from the victim’s pool and sells it for ETH.

The protocol then performs a buyback-and-burn strategy from the DRC-ETH pool.

Lower Transaction Costs

Given the protocol’s design, users lower their overall gas costs. Because, if they were farming in the victim’s pools directly they would need to manually claim rewards. As a result, staking in the DRC pools generally returns a higher profit than staking in the victim’s pool directly.

- The easiest way to think of Dracula Protocol is to see it as a Layer 2 solution for farming protocols. Essentially, the platform is acting much like a Vault from Yearn Finance but for liquidity provider tokens. It automatically auto compounds your rewards to absorb all the APY from the DeFi ecosystem into DRC token.

Lower APY, higher ROI… Another unique approach is farming is slower. The minting of DRC token is capped to 90% of the victim’s pool APY. This choice aim is to provide permanent value accumulation. Meaning users do not have to immediately claim their DRC and sell their rewards. Ending in a more sustainable farming experience and attractive token for retail investors!