What is Growth DeFi? GRO Token Explained

Growth is a decentralized finance (DeFi) platform building on top of successful protocols such as Aave, Compound, and Curve. The idea is that Growth DeFi enables users to automatically maximize their yields with a hands-off approach.

What is Growth DeFi?

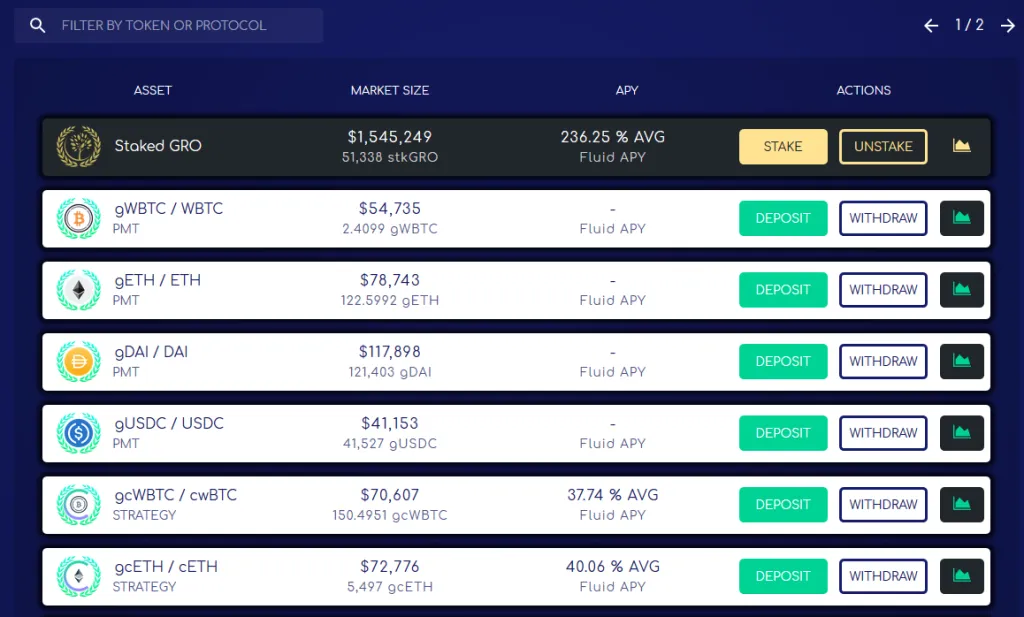

The platform aims to become a full DeFi suite offering optimized strategies for all protocols. At its core, we find gTokens which act similarly to vTokens on Venus Protocol. However, gTokens are not just an interest-bearing token that represents a user’s deposited funds into the protocol. Because gTokens also benefit from deposit and withdrawal fees. When a user redeems or mints gTokens there is a 1% fee. Half of the fee is added to locked liquidity pools with GRO pairs. The remaining half is burned to increase scarcity and drive demand.

As a result, users holding gTokens benefit from the yield of the underlying protocol (for example Aave) along with the arbitrage profits of the minting and burning fees. Additionally, users can always count on low slippage with near no impermanent loss because the protocol constantly locks up liquidity.

GRO Token Explained

GRO is the protocol’s governance token, with a total supply of 1,000,000. The main use case is staking to participate in proposal voting, meaning users control future developments.

- Staking: to participate in governance users must stake their GRO, however, there are no lock-up mechanisms. Users receive stkGRO which means their tokens remain liquid.

- Liquidity: All liquidity for gTokens comes from a GRO pair, meaning users can always buy and sell with low slippage.

- Deflationary: When minting gTokens a portion of the fees are burnt. Additionally, when staking GRO for governance there is a 10% fee, half of these fees are burnt.

Growth DeFi positions themselves as a sustainable farming protocol, where the tokenomic design intends for holding over long-term periods. Essentially, the team hopes to provide an ecosystem that provides users with investment stability as they see no limits to which protocol they can build onto next. The v1 code has gone through a complete audit by ConsenSys Diligence – so growth will keep growing? (Pun intended)