What is Hakka Finance and BlackHoleSwap?

Hakka Finance is a decentralized autonomous organization, or DAO, that launched early August. The team is building a DeFi ecosystem around several unique products, such as BlackHoleSwap, following community governance. The project features the HAKKA governance token, which gives holders voting power to decide the path of future products. Hakka finance aims to reach a final form of being a prosperous DeFi ecosystem, where holders receive a corresponding share of the revenue.

The project seems to be flying a little under the radar, perhaps the crypto community will only follow copycat DeFi protocols? Their loss! Unlike the abundance of yield farming copycats launching daily (with no actual product!), Hakka is not a clone project. The dev team already has a history of releasing innovative dApps: Fulcrum Emergency Injection or Tokenizing CDP. And their flagship product BlackHoleSwap is live and operational.

What is BlackHoleSwap?

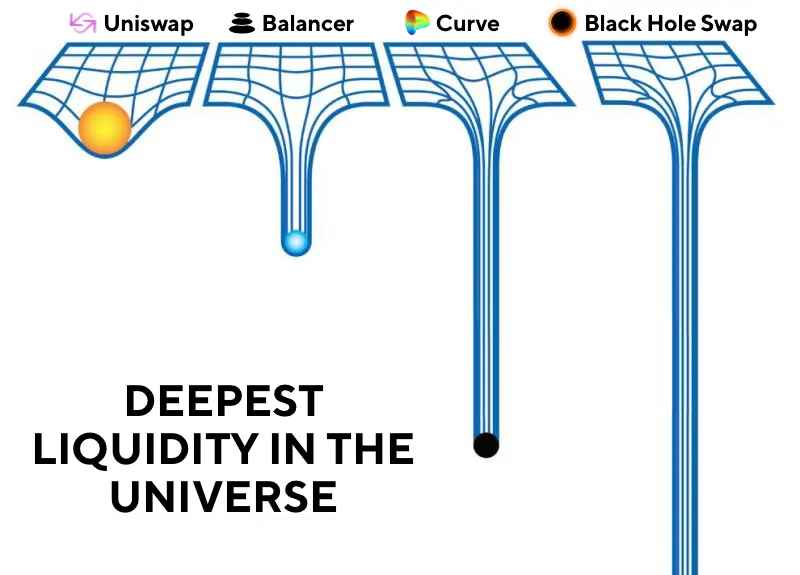

BlackHoleSwap is a decentralized AMM (Automatic Market Maker) for swapping stablecoins, you could compare it to Mooniswap or Curve. However, BlackHoleSwap has a unique design that enables near-infinite liquidity. Because it integrates several lending and borrowing DeFi protocols such as MakerDAO or Compound.

This way the protocol can leverage unused liquidity (excess supply) to borrow on the inadequate side. As a result, BlackHoleSwap can execute trades with low slippage far exceeding its existing liquidity. Hence the birth of a new meme: deepest liquidity in the universe. On a more serious note, the design could make it ideal for whales looking to hedge into different stablecoins given the ability to handle large orders. Furthermore, the protocol’s smart contracts have been audited by Peckshield.

What is HAKKA governance token?

Token holders will eventually form HakkaDAO, which is set to happen in Phase 4 of the governance roadmap. What is interesting about HakkaDAO is it will not just be governing BlackHoleSwap, the team is building a whole range of DeFi products. This is very exciting, as it shows the team is forward-thinking and building with purpose.

Liquidity mining will distribute most of the tokens, which will last 214 weeks. Though the number of rewards will go down each week, making it worthwhile to get in early. One thing to note is that early investors are up by over 1000x on initial sale price. As a result, I recommend this project for farming but it may not be the best token to start trading. Given that early investors could dump on you at any moment. Importantly, the team is very transparent with all past sales, prices, vesting – which you can find here.

How to earn HAKKA tokens?

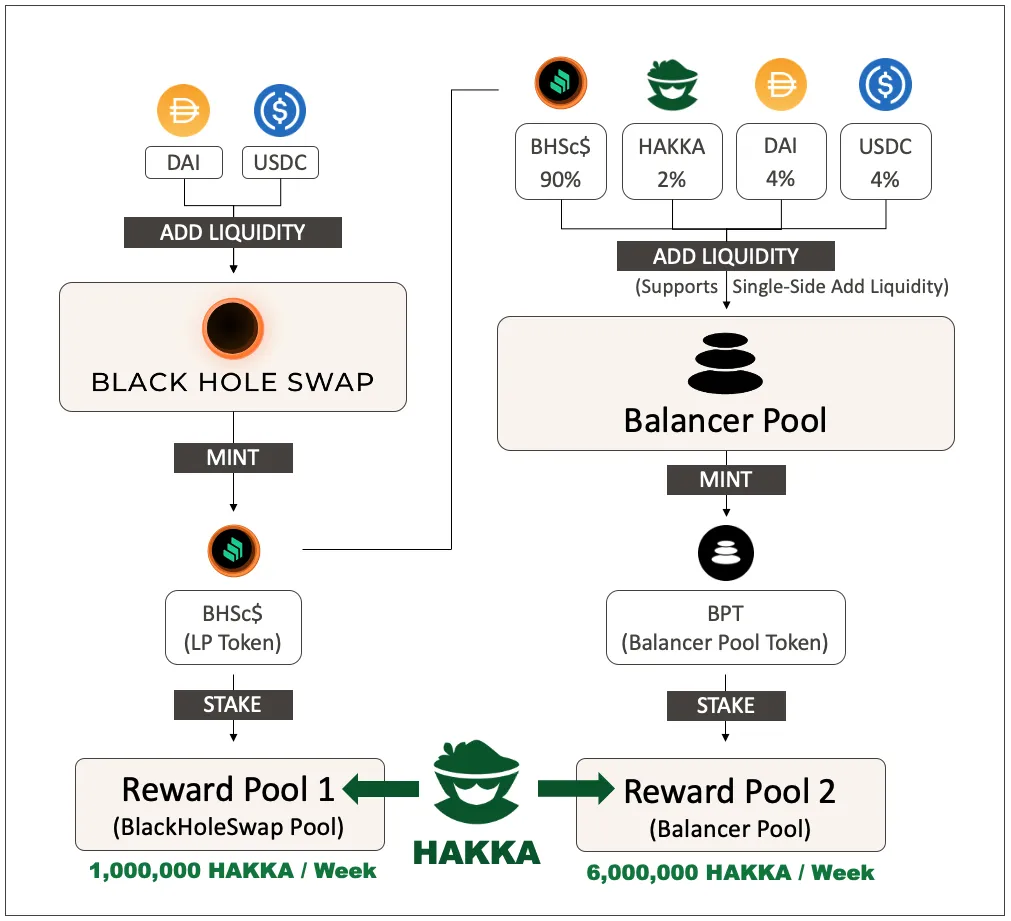

Liquidity mining on BlackHoleSwap is relatively new, so you should exercise caution. You can earn HAKKA tokens as rewards for providing liquidity to the BlackHoleSwap DAI/USDC pair and/or this HAKKA Balancer pool. Meaning there are two rewards pools, with HAKKA’s distribution as per below.

Remember, you must stake your liquidity tokens in the Rewards Dashboard or you will not earn anything. The easiest access path is via the Balancer pool because you can enter with HAKKA, DAI, USDC, or BHSc tokens. Plus it distributes x6 the amount of HAKKA tokens.

Happy yield farming!