What is Mithril Cash (MIC)? Algorithmic Stablecoin

Mithril Cash is an algorithmic stablecoin that adjusts its supply to move the price in the direction of the price target. In this case, as MIC aims to be a stable token its target value is pegged to 1 USD. Here we will look at what is Mithril Cash (MIC) and breakdown how the three token protocol works.

Just another stablecoin?

No not at all! What’s interesting here is that it throws away the concept that stablecoins in cryptocurrency need to be backed by fiat or other crypto assets. Mithril Cash is a stable token through maths and economics, you could think of it as the next generation of stablecoins. Essentially, the token follows a different type of economic model than other stablecoins such as DAI or USDT. At its core, the protocol is a fork of the Basis Cash, which the team believes is a battle-hardened design.

How does Mithril Cash work?

The protocol functions similarly to the way central banks will buy and sell bonds (fiscal debt) through their monetary policy to keep the stability of fiat money. Only instead of relying on a central authority to do this opaquely, Mithril Cash follows programmed rules in the form of smart contracts on Ethereum. As a result, the system is transparent and decentralized.

Three Token System

You find three different assets in the Mithril Cash protocol.

- Mithril Cash (MIC): a stablecoin that aims to keep a value-pegged to 1 US Dollar.

- Mithril Bond (MIB): this token should be seen as IOUs issued by the protocol to buyback MIC when the price is under $1. As a result, bonds are sold at a discount and redeemed at $1 when the protocol stabilizes the price.

- Mithril Share (MIS): If all the bonds are redeemed during the seigniorage time (explained below), MIS stakers will receive MIC tokens as rewards. As a result, MIS holders are seen as the backbone of the protocol.

Stability Mechanism

- Contraction: when the price of MIC is under $1, users can buy MIBs with MIC at a discount. This removes MIC from circulation to guide the price up to $1.

- Expansion: when the price of MIC is above $1, users can redeem their MIBs for MIC at the rate of 1:1. This increases MIC in circulation to guide the price down to $1.

- Seigniorage time: If the price is trading above $1 but there no more bonds to be redeemed or no bondholder willing to perform redemption. Then the protocol mints new MIC to distribute proportionately amongst MIS stakers.

To summarize, Mithril Cash is more elegant than a simple one token rebasing model popularized by Ampleforth. The three token design is engineered for MIC to hold its peg long-term and avoid continuous rebases that hurt holders. Which is a flaw we find in AMPL, BASED, or YAM.

Looking to the future

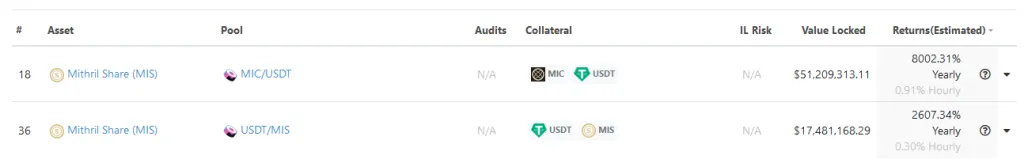

Both MIC and MIS tokens have a healthy amount of liquidity in SushiSwap. During the last 24 hours, there was a combined trading volume of over $96 million – so there is a lot of interest in Mithril Cash’s use as a stablecoin from traders. Furthermore, both pools look very appealing for farming. Currently, providing liquidity to MIC-USDT or MIS-USDT pairs will earn you over 2000-8000% APY. Additionally, the protocol completed its first Seigniorage time (the protocol’s form of rebasing) successfully.

Fiat ramps: Mithril Cash’s partnership with QCPCapital enables users to on/off their MIC stablecoin directly into fiat. Regulation is opening up for banks to use stablecoins for payments, meaning we could see MIC powering more traditional financial instruments in the future.

- Remember MIC keeps its peg purely through market economics, there is no need to trust a central entity or rely on huge amounts of collateral. Essentially, there are no barriers to it being used in DeFi or traditional banking.

Integrations: You can’t be a stablecoin on Ethereum without adoption into the wider DeFi economy. The team is working quickly to ensure this is the case with staking enabled in the DeBankDeFi dashboard and a potential listing on Cream Finance.

One to watch! Make sure you jump in their telegram or discord to learn more and follow future announcements.