What is Non-Fungible Yearn? DeFi Vaults with NFTs

Non-Fungible Yearn is a DeFi platform where users can stake in various pools to earn NFY tokens. On the surface, NFY Finance may sound like another yield generating staking platform using the popular Vault strategies – but it’s not. Here we have a platform taking a different approach to DeFi by minting non-fungible tokens (NFTs). These unique NFTs then represent the rights to a stake.

What is Non-Fungible Yearn?

While it is common practice for platforms to represent yield based on the amount a user stakes, this causes several problems. Notably, the expensive gas costs incurred by constantly staking and unstaking funds. Generally, as these types of transactions interact with smart contracts they always need more gas to confirm. As a result, you have a vicious circle where farming protocols congest the network making it slow and expensive for everyone.

A Better Way To DeFi

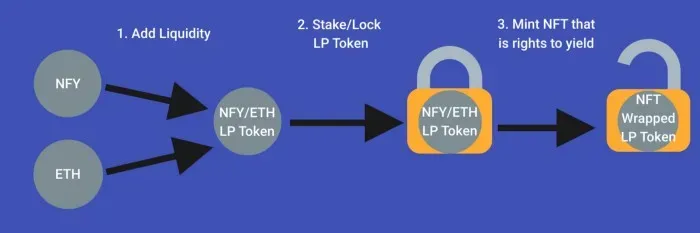

NFY Finance believes the solution is by using the ERC-721 token standard. Meaning all the details of your stake, along with the interest accrued will be stored in a unique crypto collectible. Anyone holding the NFT has the right to claim accrued interest or redeem the underlying tokens. Essentially, the team is putting forth the notion that users should not need to unstake when they’re done with a protocol. We could be saving a lot of time and gas fees by simply trading the rights of the stake itself. Because a simple token transfer as an NFT is not an expensive transaction, which you can do via OpenSea or Rarible.

Unstaking… Users can still unstake their deposits from a vault, which will destroy the NFT and return the stake funds. However, to encourage an ecosystem of trading NFTs a 5% fee will be taken to redistribute to the protocol.

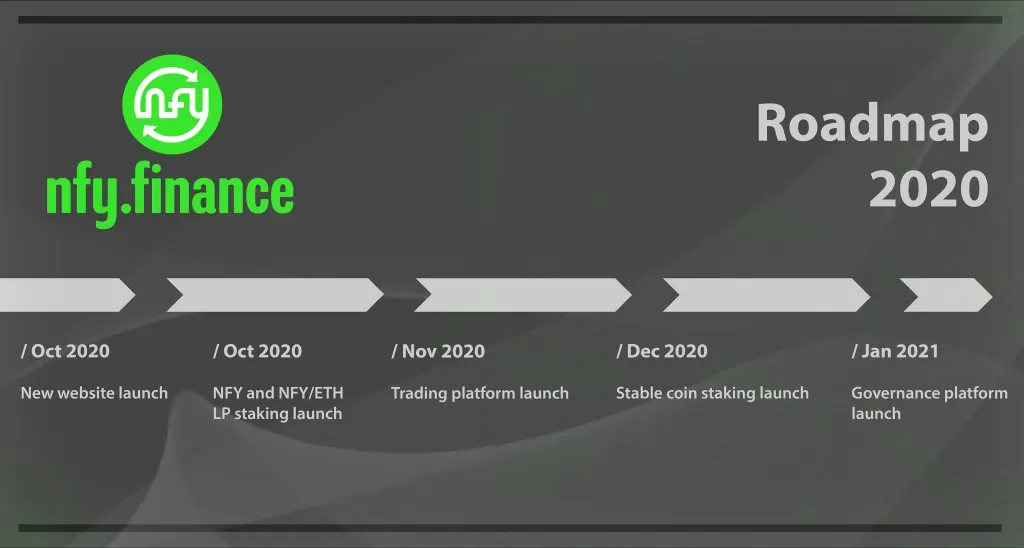

- NFY, the governance token for the platform, has a total supply of 100,000 to avoid over-emission problems. Additionally, all earned rewards tokens will be locked for the first 21 days.

Liquidity locking… the team is also planning to reward NFY/ETH liquidity providers who agree to lock their liquidity tokens in the platform forever. This may sound scary, but remember that you will still be able to trade the rights of being a LP (and its rewards) through the minted non-fungible token.

The platform will even enable you to break it down into smaller portions by minting another NFT, making it easier for a whale to sell a massive stake.