Yfv Finance launches Value Vaults

Yfv Finance, a popular platform for automated yield farming, has released its much-anticipated Value Vaults products. DeFi vaults are one of the most used products by yield farmers, popularized by Andre Cronje with Yearn Finance. Every yield generating platform seems to be attempting to outplay the other, innovating their DeFi strategies. Consequently, each platform is at war trying to offer the best returns for their users.

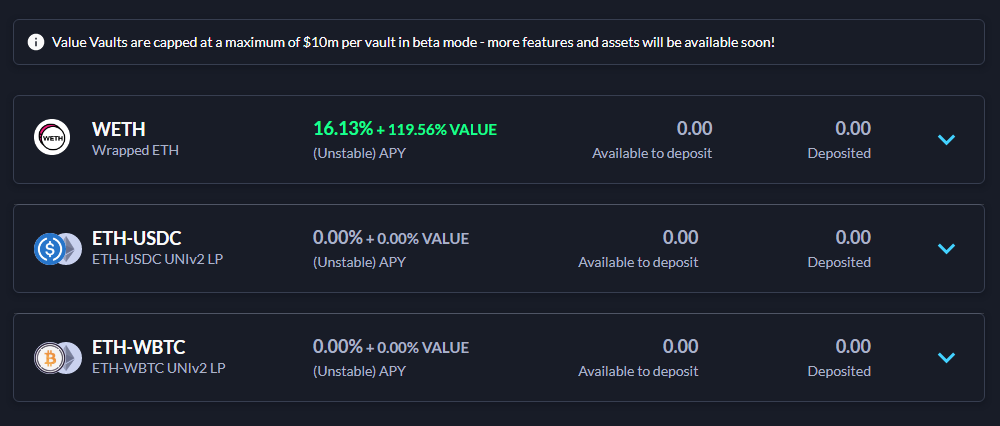

Yfv finance launches Value Vaults

Value Vaults will automatically allocate capital towards the DeFi protocols offering the highest APY. This way users can deposit their funds and let Yfv do the rest. Such as, automatically claiming rewards and compounding them. Essentially, done by enabling users to deposit single crypto-assets into the Yfv platform.

Turning the Value Vault into one super investor. As a result, users save massively on gas fees and there are also no platform fees. Meaning all the profit your deposits generate, are coming back to you upon withdrawal.

Farming both SUSHI and UNI… Yfv Finance, the team building Value Liquidity, states they have integrated the most advanced DeFi techniques into Value Vault’s yield farming strategies. One of the innovative approaches is that the product does not just follow one strategy with one controller. It is possible for the vault to split up its funds into different ratios. Each one following a different strategy, for example, users could farm both SUSHI and UNI tokens.

- Important because other yield aggregators on the market may offer high APYs. But they cannot absorb high amounts of liquidity, hence they have a cap on deposits. As Value Vaults will follow multiple strategies, allocating capital into different DeFi protocols, they can theoretically remove any cap on deposits.

Positive reaction… As a security precaution, the team has elected to release the different DeFi products gradually in a beta mode (with a $10M cap) until audits have been completed. This has not stopped excitement, with over $6M of ETH being deposited into the first Value Vault within 24 hours.