What is TrueFi? Uncollateralized Lending is here

TrueFi is a DeFi lending protocol launched by TrustToken, the team behind the TrueUSD (TUSD) stablecoin. Notably, the platform enables vetted borrowers access to capital without needing to lock up funds as collateral. TrueFi recently went live to mainnet on Ethereum, along with farming of their TRU governance token – here is what you need to know!

What is TrueFi?

TrueFi is a DeFi lending platform, much like Aave or Venus, which lets you earn interest on stablecoin deposits. However, there is a key difference as TrueFi enables borrowers to secure uncollateralized loans. The idea is the protocol will attract major industry players and institutions (such as OTC desks, exchanges, or other DeFi protocols) as borrowers, looking to secure high-value long term loans. Or new use cases for lending on-chain such as the real-estate sector, think mortgages, or commercial investment loans. Currently, these are untapped traditional markets for DeFi given existing protocols are not realistic options for high-value loans.

Uncollateralized Lending

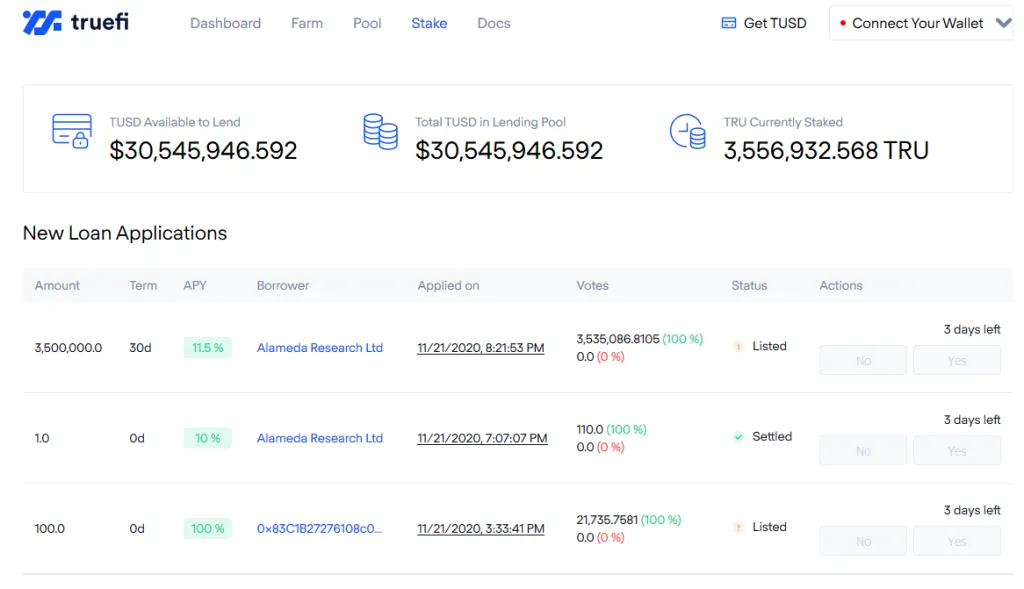

For example, one of the first loan requests is from Alameda Research (FTX Exchange) for the amount of 3,500,000 USD. The reason this is important is that high-value loans mean lenders on TrueFi will earn long-term returns.

As a result, we can expect the APY rates for lenders to remain consistent and sustainable. Furthermore, the protocol design is capital efficient and will deposit any unused funds into Curve to maximize the lender’s earnings. To summarize, these are attractive points for lenders, seen by the protocol locking up over $30M in just 3 days after launch.

It’s important to note this type of lending could be riskier than depositing stablecoins into protocols that do require collateral. In case of a default, lenders could lose a portion or all of their funds. TrueFi mitigates this risk by maintaining a whitelist of vetted borrowers. Additionally, TRU stakers have the final say by assessing the creditworthiness of the borrower and voting over loan approval. Lastly, in the case of a delinquent borrower, TrueFi will take legal action to recover the loan.

TRU Token

The protocol is powered by TRU token which holds the following use cases:

- Staking: when a loan request comes through TRU token holders stake to vote “Yes” or “No” over the loan’s approval. Stakers are incentivized to vote carefully as their rewards are based on if the loan ends up being repaid successfully.

- Farming: to bootstrap liquidity TRU tokens are initially being distributed as rewards to lenders, stakers, and through liquidity mining programs on Uniswap or Balancer.

- Governance: once TRU is fairly distributed and decentralized, the future development of TrueFi will be community-driven.

Here is the breakdown of TRU token allocation, which will all distribute via farming:

Don’t forget to be eligible to earn TRU tokens, you need to stake your LP tokens in one of the pools.

Looking to the future

It’s quite early to speculate over if TrueFi will become an industry leader for DeFi lending, and if the demand/value for TRU token will grow. That being said TrustToken is doing a lot of things right from launch, which is a great sign:

- Protocol code has gone through a full security audit by Slowmist.

- Fair launch as TRU distribution is 100% through farming. Furthermore, any tokens the team farms with their funds will either be burnt or reinvested into the community.

- The protocol collects a 0.25% fee from borrowers which goes into the community treasury (governed by TRU holders).

- TRU token does not follow an inflationary economic model as it has a fixed supply. Meaning potential yield farmers don’t have to be as worried about constant downwards selling pressure.

- The backend tech powering on-chain loans can plug into other applications by independent developers. Essentially, TrueFi can become a new building block for the whole DeFi economy.

Final Thoughts: Powered By TrustToken

We should also mention that TrustToken successfully operates stablecoins for five major fiat currencies, and has been doing so for years. TUSD is considered by many to be the most transparent US Dollar stablecoins on the market as it ticks all the regulatory boxes.

~48h from launch, #TrueFi TVL rank on @DefiLlama at #34

— TrueFi.io 💸 (@TrustToken) November 23, 2020

Good start 💪 pic.twitter.com/lIWBBrwqaf

Expect quick growth: TrueFi will leapfrog a lot of DeFi protocols, in terms of TVL rankings, by attracting capital simply off their industry reputation alone. Along with TRU listings on major cryptocurrency exchanges.

- Recently the team announced listings on TokenizerDeFi and Hoo Exchange.

Integrations: The same reputation will help TrueFi be widely integrated into analytic tools, portfolio trackers, and other DeFi protocols. All speeding up the protocol’s adoption and growth!

Want to learn more? Jump in their discord server to join their community.