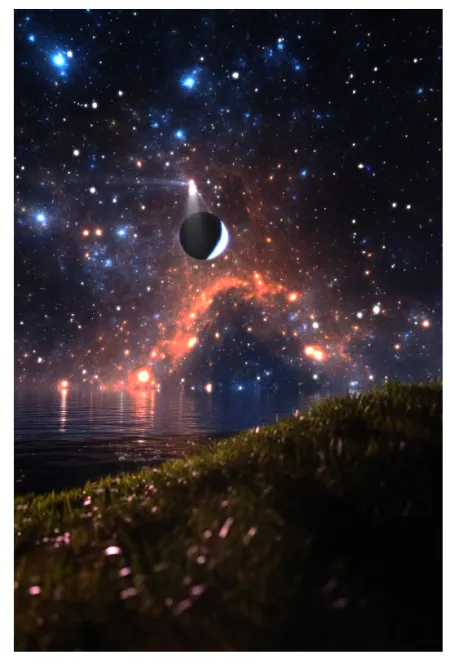

Deja Vu

Bitcoin back to trading at $50k and funding rates are going up again... a familiar story? Only question is will BTC make a new ATH this year.

Bitcoin is back to $50k and funding rates are getting high again… eh are we doing a full circle? Things have been looking very bullish across the board for BTC, defending its 4H trend above all 20&50 EMAs.

Would say funding rates are getting a little high again, a dump down to the weekly open (blue line) could give us a very nice long entry. Any major resistance at Monday’s High would then be a trigger to get out of that position.

Where to trade?

Here are my favourite crypto exchanges, use the referral link for atleast a 10% discount on your trading fees.

- Bybit - Currently, this is my favourite platform! Great liquidity and bonuses for deposits.

- Delta Exchange - Good for a degen account, no KYC required but low liquidity.

- Binance - Lots and lots of spot altcoin pairs, especially BTC pairs.

- KuCoin - Great for longer small cap holds.

Crypto News

- Binance: More regulatory concerns on the horizon? Despite the exchange now putting in place mandatory KYC for all accounts, governments are still publishing warnings that the platform operates with licenses.

- PayPal: Announced it will soon allow UK users to buy, sell, and hold crypto. On launch, the service will be limited to Bitcoin, Ethereum, Litecoin, and Bitcoin Cash.

- Google: Rumours are now circulating that the big tech giant Google is planning an entry into crypto, creating their own blockchain and token. While it seems to all be predictions at this stage, apps such as Google Play having their currency does seem logical?

- Grayscale: The massive crypto asset manager now has over $10B worth of Ethereum under its management. And don’t forget about its $30B worth of Bitcoin!

DeFi News

- Cropper Finance: The permissionless yield farming platform that will enable teams to create liquidity programs for their community in just a couple of clicks, will launch on Solana in a couple of hours. Powered by its native CRP token.

- Avalanche: Might be the next smart contract chain to see an explosion of DeFi platforms, as the foundation announced a $180M DeFi incentive program.

- Luna Yield: And the rug pulls have arrived in Solana, with the Luna Yield platform going dark and running off with $6.7M in investor funds. Worryingly, the platform baited investors by going through the SolPad IDO platform, which means their due diligence is poor!

- Gelato: Announced details for its GEL token, along with sale details scheduled for September 13th, 2021. The platform already has partners such as Aave, Polygon, and The Graph so expect this sale to receive a lot of attention.

- HyperJump: Do check out the UnRekt tool if you’ve been aping into farms and staking pools on BSC or Fantom. UnRekt can revoke access from any approval you gave to malicious contracts.

- deBridge: Announced a cross-chain and liquidity transfer protocol that will support Ethereum, Polygon, Heco, BSC, and Arbitrum. What’s very interesting is that the protocol also enables cross-chain composability of smart contracts.

- Skyrim: An upcoming multichain robo-advisor of DeFi platforms, powered by SKYRIM token. Whitelisting for their token sale will open on August 27th, one to research!

NFT Spotlight

Be sure to check the listing to view the digital crypto artwork in its full glory, as some art is animated or contains audio.

Deja Vu

- Where to bid? MakersPlace or Opensea.

- Artist: Reema.

NFT News

- Visa: After years of blocking so many customer crypto transactions, it seems the days of being anti-cryptocurrency are firmly behind them. Visa announced they now hold a CryptoPunk NFT.

- Pinkslip Finance: This upcoming DeFi game will combine NFTs with drag racing, and compete to earn a spot in the staking pool for passive income. Interesting, the native token is PSLIP, one to watch!

- Mountaintop: Future metaverse game, early days but one to research? Just announced they’ve raised $30M in a Series A which included VCs like Spark Capital, Founders Fund, and Detroit Venture Partners.