Furucombo let’s you save gas for your DeFi strategies

Furucombo is an amazing tool for DeFi enthusiasts as it allows you to easily bundle multiple protocol actions into one transaction. Just ask yourself, why click and confirm five Ethereum transactions, when I could just confirm one? Not only will using Furucombo save you time, but it will also optimize your actions to save on gas fees. Such as setting up a DeFi strategy for farming CRV tokens.

Given Ethereum’s transaction fees are currently very high, any tool that can enable you to save: is a must-learn! Essentially, Furucombo allows you to build your custom DeFi strategies without knowing any lines of code. You can just drop and drag DeFi protocol actions using their UI.

- Note Furucombo is beta software, use at your own risk

What is Furucombo?

Furucombo is a tool for optimizing your DeFi strategy with a simple drag and drop interface. Furucombo refers to different protocols as cubes, as a result, you are building your DeFi legos without knowing any solidity (Ethereum’s smart contract programming language). Once you have created your combo, the tool will package everything into one transaction.

This is particularly great if you need to use several different protocols. For example, if you want to swap tokens via 1inch to add them as liquidity on Mooniswap or deposit in a Yearn Finance vault. You can easily visualize every required step with their UI, making the tool very beginner-friendly. More experienced users may find Furucombo the easiest way to leverage a flash loan from Aave, to take advantage of arbitrage opportunities between protocols. It also makes it very easy to participate in liquidity mining or yield farming incentives.

Which we are going to look at below in the following step by step DeFi tutorial for farming CRV tokens.

Example Combo

Earn stablecoin interest and farm CRV tokens.

Let’s imagine you currently have a bearish outlook on Ethereum, or simply know you won’t have time to monitor your trading portfolio closely. In this scenario, you will probably want to move a percentage of your funds into a stablecoin, to lower your exposure and risk. Now what we can do is put those funds to work, earn interest, by depositing them into Curve Finance. As a bonus, we will also start earning rewards in CRV tokens.

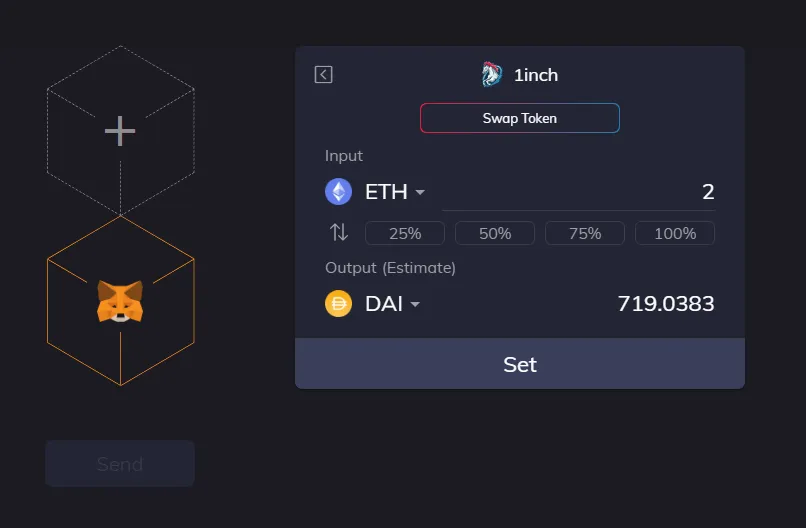

Step 1: swap ETH to DAI

First, we will need a stablecoin to supply, I have selected Swap Token using 1nch to set up a swap from ETH to Maker’s DAI.

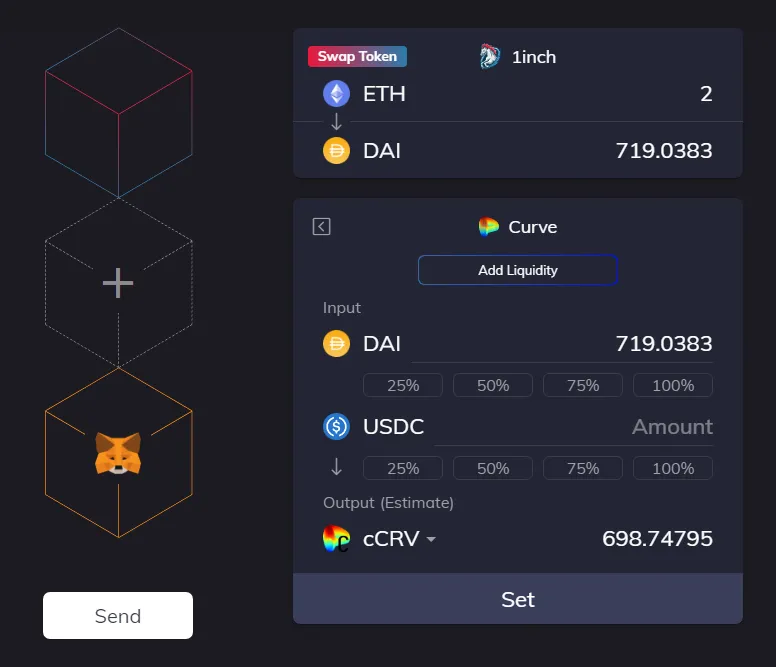

Step 2: supply DAI to Curve

Next, we need to deposit our DAI into a Curve pool, note there are several different ones. I have selected to receive cCRV which is Compound’s pool because it currently offers the highest CRV distribution.

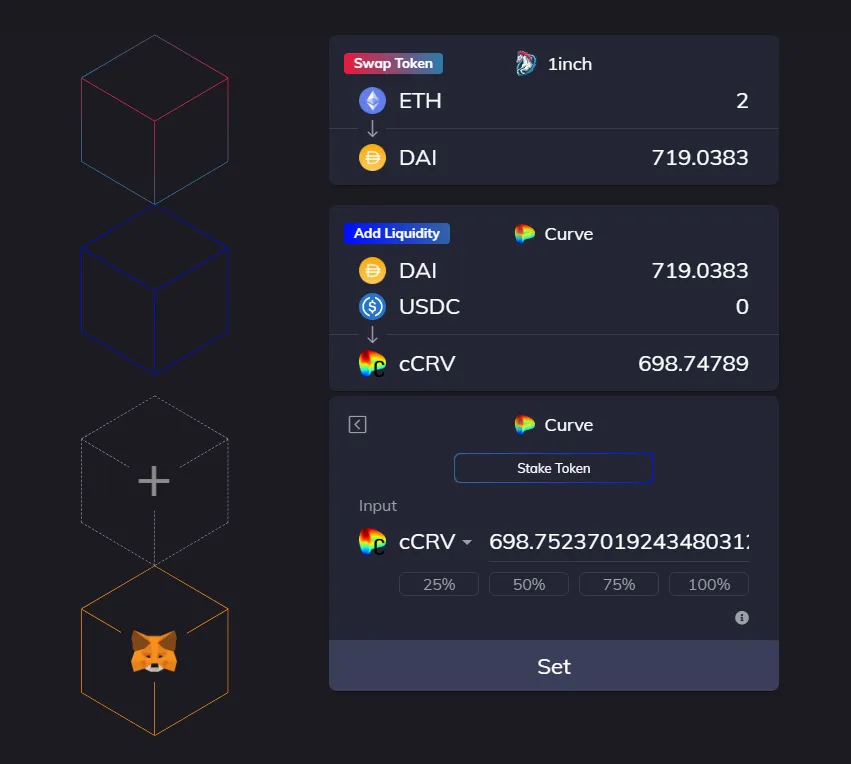

Step 3: stake LP tokens

We need to stake our Curve LP tokens because we want to receive rewards while also earning interest on our DAI tokens.

Step 4: Sending it out

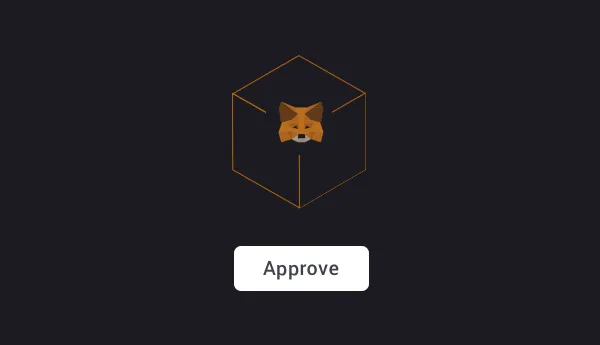

Once you are happy with your combo, you will need to click Approve and then Send. Initially, Furucombo will run an estimation of your transaction.

If your transaction will fail, then you will be prompted to fix your combo. However, if everything looks smooth then you will be asked to sign the transaction in your wallet.

- Pro tip: click the share icon to create a unique link for your combo, which you can save for future use.

One thing to remember is Furucombo does not have every DeFi protocol integrated, such as Akropolis, which may offer higher returns. So it is good to check around!

Congrats! You should have completed your first combo DeFi transaction on Ethereum. If you did get lost at any point in the tutorial, feel free to look at the saved version.

Any requests for future tutorials? Let us know!