Is Zap Protocol the Ultimate DeFi Developer Toolkit?

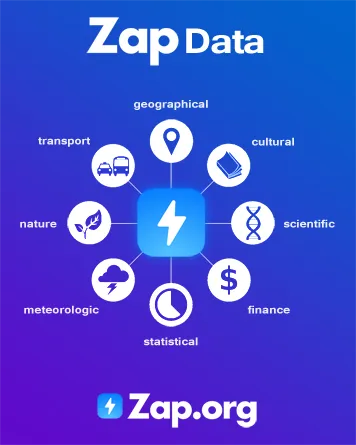

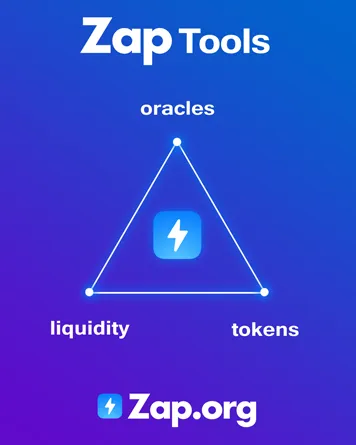

Zap Protocol is credited with being the first team to launch a decentralized oracle platform to mainnet on January 1st, 2019. You can think of Zap as a toolkit for DeFi developers which focuses on three main components: Data, Tokens, and Bonding Curves.

What is Zap Protocol?

Though many think of Zap Protocol as an oracle platform such as Dia, the platform is much more. At its core, it’s a permissionless protocol that enables anyone to buy or sell data, create liquid tokens, and set predefined pricing curves. Along with enabling people to bond and un-bond money to these curves. That’s a lot of powerful features packed into one protocol, let’s just look at some example use cases to understand how a developer could leverage these tools.

Example use cases:

- Monetize API feeds.

- Deploy always-liquid tokens that can burn and mint autonomously.

- Track a supply chain from A to Z.

- Tokenize yourself in seconds.

- Tokenize a pro-athletes career.

- Launch a crypto collateralized stablecoin token.

- Launch a DEX with instant liquidity.

- Create an asset that automatically trades on a DEX.

- Launch a DAO.

- Curation markets.

- Invest in oracle feeds that you believe are useful.

And more! Essentially, Zap enables developers to quickly deploy applications that combine features from some of the most successful use cases on Ethereum: data, tokenization, and bonding curves. Just think of the success you see in Chainlink, Uniswap, or Curve.

Zap Oracles

It’s becoming more apparent that the sourcing of reliable data to power the DeFi economy will be paramount for future growth. The issue is that most of the data exist outside of the blockchain, and is not accessible to smart contracts. For example, how could decentralized travel insurance calculate payouts if it did not have access to flight or weather information?

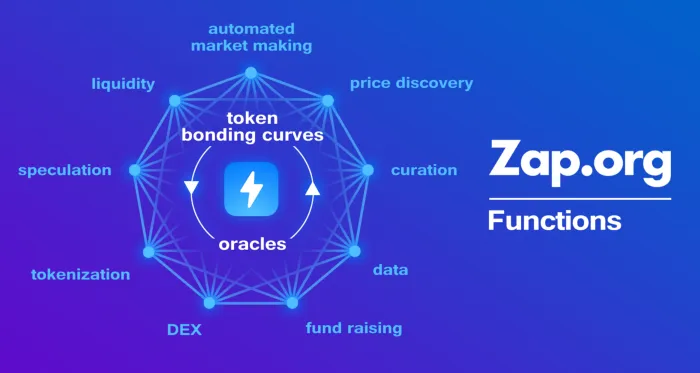

Zap Data enables the buying and selling of data in a permissionless environment. However, unlike competitor platforms such as Tellor, oracles built on Zap are also investment vehicles. Meaning you can speculate on the value of the oracle model and its underlying data. The idea is that this design also serves as a reputation and trustworthiness check. Because the better oracles will have more money bonded to them, whereas, malicious oracles will quickly drop in price. As a result, users quickly see which oracles are the most useful and reliable.

Liquid Tokens

Tokens on Zap Protocol act a little differently than your average ERC20 Ethereum token. These tokens are never illiquid because the token’s supply adjusts dynamically to demand. Essentially, the token is minted and burned automatically as people bond or un-bond to their bonding curves. Furthermore, the tokens are also compatible with existing decentralized exchanges so can be traded outside of Zap Protocol. Which can enable a healthy amount of arbitrage trading through secondary markets.

To summarize quickly, you can tokenize anything and use oracles to track whatever data needed for the pricing feeds. For example, you could instantly launch a synthetic commodity token that pegs itself to the price of gold. Or tokenize a basket of stocks and real estate simultaneously to launch a diversified index fund.

Bonding Curves

This would be the backbone of the Zap Protocol, given they are what users bond and un-bond money to. All of this process happens on-chain, as a network of smart contracts powers the bonding curve mechanisms. When a user bonds, tokens are minted and the price moves higher up the curve. If a user decides to leave the bond, then the reverse will happen. Tokens will be burnt when exchanged back to ZAP, and the price will go down the curve.

It may be easier to think of this concept as a token-issuing DEX that mints and burns the tokens autonomously as users buy and sell.

Summary: Eyes on Zap Protocol 2.0?

There are a lot of powerful features to leverage in the Zap Protocol, some of which we have highlighted today:

- Oracles data feeds in the form of APIs for smart contract use.

- Limitless amount of tokenization use cases.

- Tokens that auto-adjust supply for constant liquidity.

- Bonding and variable pricing to power curation, fair price discovery, reputation, and incentivization.

It’s a wonder why it is often overlooked in discussions of technology around Oracle and Data economy for DeFi and Web 3. Potentially, one reason is the protocol is only developer-friendly and it’s hard to make use of the tech as an average user. We know the demand for crypto index funds is here, just look at PieDAO, Balancer, or Axia. Another use case that Zap Protocol could power in minutes. However, industry leaders are taking notice of the tech, as seen by Coingecko using Zap to curate and monetize their data feeds.

@ZapProtocol is excited to partner with @coingecko, a leader in providing crypto-specific market data & analysis.

— Zap.org (@ZapProtocol) March 9, 2020

Our innovative and decentralized bonding curve technology will be used to curate high-quality data feeds for users of their platform.https://t.co/M0YYCHkjtw

To summarize, we would watch out for the release of Zap Protocol 2.0 closely. This is a major upgrade milestone that will improve the portal’s UI massively, including drag and drop features for launching bonding curves. Breaking down barriers to using Zap’s repertoire of tools is how the protocol will grow!