What is Axia Protocol? Decentralized Crypto Index Fund

Axia Protocol is a DeFi platform that combines a crypto index fund with yield farming opportunities. The idea is to enable users to easily invest in trending blockchain projects along with daily rewards in AXIA tokens. Essentially, Axia Protocol is attempting to build a platform suitable for retail crypto investors and yield farmers alike.

What is Axia Protocol?

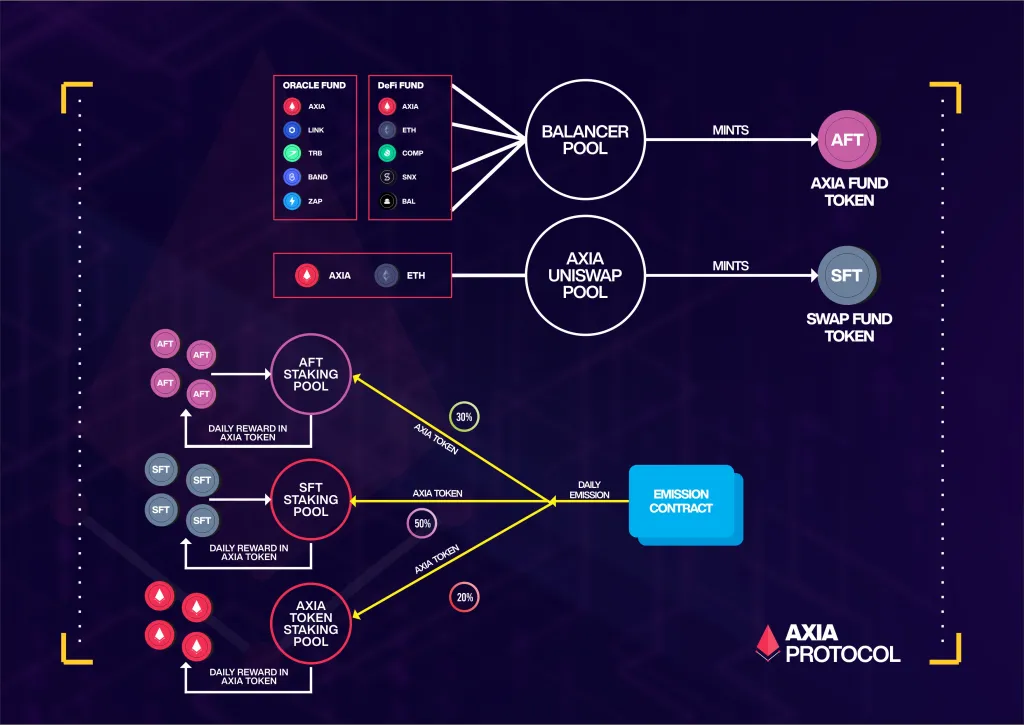

A major problem in cryptocurrency is there are just so many different types of projects, use cases, and tokens. As an investor, you can quickly become overwhelmed and lost in a sea of projects that often resemble each other closely. Axia Protocol creates two index funds that track the performances of two major blockchain trends: Oracles and DeFi assets. As a result, users can hold the fund tokens ATF to gain exposure to a basket of assets. Furthermore, the index funds use Balancer pools in the backend meaning holders also earn fees from any swaps going through the pools.

We find the following assets in Axia’s index funds:

- Oracle Fund (Balancer pool): AXIA, LINK, TRB, BAND, ZAP

- DeFi Fund (Balancer pool): AXIA, ETH, COMP, SNX, BAL

- Swap Fund (Uniswap Pool): AXIA, ETH

Currently, there is no mention in the Whitepaper of additional index funds being created. However, the creation of a riskier low cap DeFi index fund could be a great addition.

AXIA Liquidity Mining

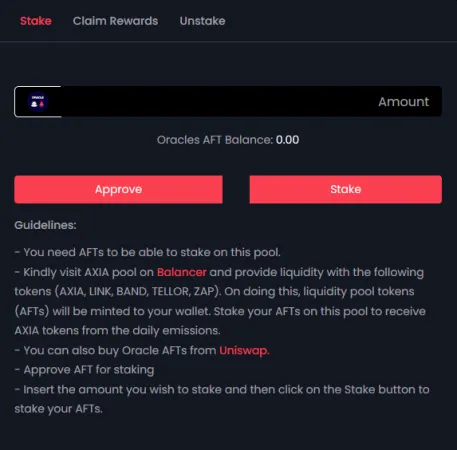

Not only can you save time and energy by investing via Axia Protocol, but you can also earn AXIA tokens in rewards. You can access the liquidity mining programs via the staking dashboard. Each index fund has its liquidity mining program to earn rewards from daily AXIA emissions. Furthermore, users who do not want to take any additional exposure can stake AXIA tokens as a single asset.

Important to note that stakers providing liquidity to the ETH-AXIA Uniswap pool share 45% of the daily emissions. Whereas the fund stakers share 25% and lone stakers 5%. Meaning if you are happily taking the risk of impermanent loss you could potentially earn a lot more rewards.

AXIA Tokenomics

The emission schedule is planned for over 5 years, where it halves every 180 days. There is no infinite inflation with AXIA token as it has an initial total supply of 3,800,000. To remain sustainable long term the protocol takes 5% of the daily rewards and sends them back to the emission contract. Currently, these tokens are taken out of circulation as the emission contract will not touch them until after the initial emission schedule. Additionally, the Lone Staker pool incurs a 1% unstaking fee which the protocol sends to the burn address. Which means AXIA token is also deflationary.

We listened to the community's request to have AXIA tokens part of our pools on Balancer. For this to happen, we had to make changes to our token contract in order for Balancer to support the token. We decided to stop the basis points charged on every transfer (Balancer didn't...

— Axia Protocol (@axiaprotocol) October 10, 2020

Another interesting part of this project is continuous arbitrage trading. Because AXIA tokens are listed in both index funds which are Balancer pools and the Uniswap pool. Essentially, there is a lot of opportunities to make a profit between the difference in price as the Balancer pools have other underlying assets in them also.

Note that the project is currently going through an independent security audit by Solidity Finance – so pending the report, it may be a great time to become an Axian!