Porky Pies

Somehow we have more scaremongering coming out about the Chinese government cracking down on cryptocurrencies, mainly this Reuters article. However, according to people on the ground, it appears that the media is exaggerating the state of the ban. What a way to start the week, eh?

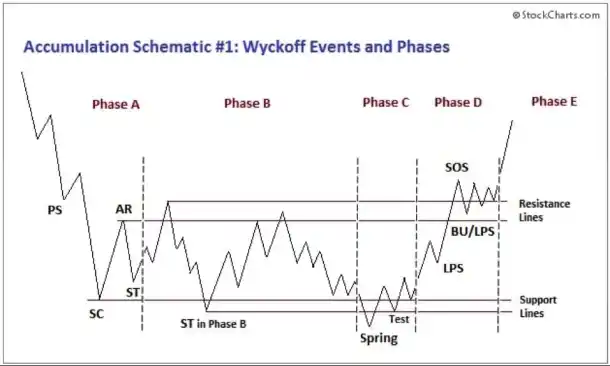

Market: If the selloff causes Bitcoin’s 30k support to break down then expect to see a cascade of liquidations and a swift drop down to 27-28k where we find whales with resting bids. That being said, if you believe we’re in Phase C of an accumulation schematic, then this could be the Spring event before we grind back up.

Good Ol Dip Buying?

Sign up via one of our referral links to following exchanges for up to 10% discount on your trading fees.

Meanwhile, instead of filling in that McDonald’s application (beras) why not start a new career in the wild world of blockchain development? Chainlink will be offering free training on writing Ethereum based solidity smart contracts.

Crypto News

- Miami: Mayor Francis Suarez has now set his sights on attracting Chinese bitcoin miners to the city, announcing they have plans in place to lower electricity prices in Florida.

- Goldman Sachs: Became the first U.S bank to trade Bitcoin futures, entering the market via a partnership with Galaxy Digital. It’s a move that we would expect banks to follow, good for adoption!

- MicroStrategy: Still buying the dip. Michael Saylor’s company is now holding 105k BTC at the average buy price of $26k.

DeFi News

- StakeDAO: Released a new passive ETH strategy for farming, which automatically stacks several protocols on top of each other for yields without impermanent loss. Currently, APR is over 300,000% so get in quick!

- Lavacake: Here is a high APR farm on BSC, currently offering over 10,000% on LAVA-BUSD with the reward token in LAVA. Just note there is a 6-day harvest lockup in place.

- Deus Finance: Now offers users the possibility of trading over 500+ stocks on Huobi Eco Chain, also live on Ethereum, BSC, xDai, and soon Polygon. One to check out!

- Venus Protocol: Seems to have broken away from Swipe’s development team, and is putting together a new core team to work on the project. Kind of unclear where this is going right now, XVS holders will need to follow closely. Learn how to use Venus in our full tutorial here.

- ACryptoS: Launched a new pool for SXP, XVS, VRT, BNB, and VAI. This is a weighted pool and functions much like Balancer, so will auto-balance your deposits. Good time to enter as APR is over 100% given it just went live.

- MakerDAO: Currently voting on a proposal to activate the Flash Mint Module, which if it passes would enable the possibility of flash minting 500,000,000 DAI. I am sure some builders will figure out a cool way to use that!

- Cozy Finance: The DeFi golden boy developer Andre Cronje released a new protocol that enables users to invest in DeFi while always keeping their initial deposits safe from hacks or exploits. Nice!

- Ren Protocol: Announced its integrations for Solana are live, meaning RenVM is providing a direct bridge for moving BTC onto the Solana network. Will be interesting to see what DeFi products appear using renBTC.

NFT Spotlight

Be sure to check the listing to view the digital crypto artwork in its full glory, as some art is animated or contains audio.

Elon Dogegirl

Looks like Elon Musk got himself a new pet. Gotta love the geneticists over in Japan, am I right? Why can’t they get cat girls sorted out already? Maybe when Elon dumps his Doge on us he can afford to fund the development of cat girls finally.

- Where to bid? MakersPlace or Opensea.

- Artist: lushsux.

NFT News

- Decentraland: An estate in the metaverse just sold for over $900k in MANA tokens, and what’s cool is the buy was made by a real estate investment firm called Republic Realm.

- BakerySwap: Announced POKER nfts are coming to the platform, namely pet branded Poker card decks. Will include blind boxes and levels of staking power for rewards.

- Bubble: Coinbase co-founder Fred Ehrsam stated in an interview with Bloomberg TV that 90% of NFTs would be worthless within just a couple of years, likening the bubble to the dotcom boom of the 1990s. So how do we know which ones won’t be worthless?