What is SupremeX Lending? SXC Token Review

SupremeX Lending is decentralized finance (DeFi) platform powered by OKExChain. Here we will look at what is the SupremeX protocol and its key features, along with a review of the SXC tokenomics.

What is OKEx Smart Chain?

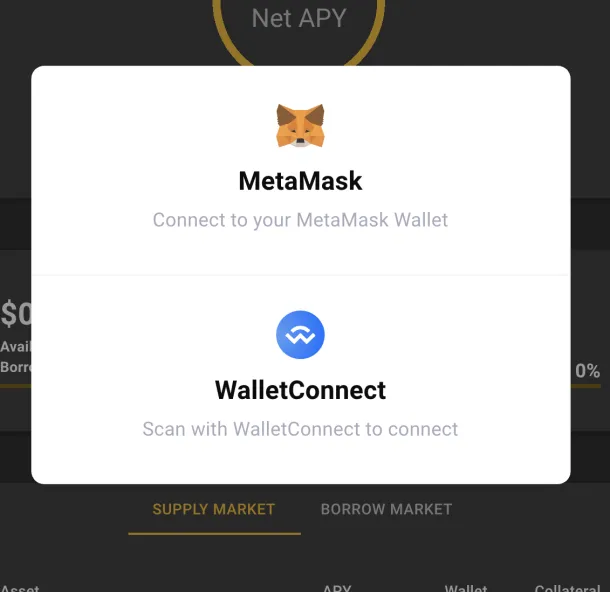

Let’s do a quick sidebar and highlight OKExChain’s strong points, as this network is fairly new launching in January 2021. It’s an EVM-compatible blockchain developed by OKEx exchange, meaning it supports all the Ethereum tooling and solidity smart contracts. This is great because existing teams developing on Ethereum, Binance Smart Chain, or Huobi Eco Chain can easily migrate and integrate support. Additionally, users can easily access its ecosystem via MetaMask.

However, don’t dismiss OKExChain as a carbon copy of Eth without the high network fees. It’s a dual network that is compatible with Cosmos’ IBC cross-chain solution, meaning it can easily tap into the emerging ATOM ecosystem. Essentially, this opens the door for a lot of cross-chain collaboration between teams without needing to think about bridges.

What is SupremeX Lending?

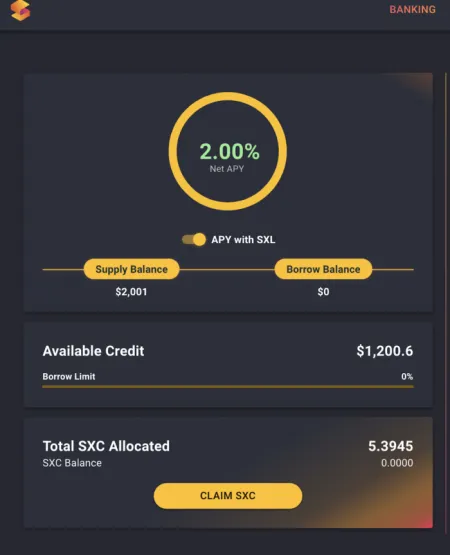

The protocol’s architecture is a mashup fork based on Compound and MakerDAO, so it is very similar to Venus Protocol on Binance Smart Chain. At its core, SupremeX powers algorithmic money markets for OIP20 assets, which are native OKEx Smart Chain tokens. Essentially, SupremeX is a DeFi lending platform, where users can deposit supported crypto assets as collateral and borrow. Additionally, users will earn interest (paid per block) on any of the crypto assets they supply to the protocol. Lastly, the protocol enables minting of the synthetic stablecoin XAI which is pegged to the value of 1 USD.

To summarize, SumpremeX aims to be one of the base building blocks for a successful and robust DeFi economy on OKExChain much like what Aave is for Ethereum.

SXC Tokenomics

SupremeX will be governed by SXC holders, an OIP20 token that has a total supply of 500,000,000. As a result, the main use case for the token is voting power. Proposals could be around tweaking the protocol parameters such as fees, product improvements, or adding new collateral options.

SXC will also be used to distribute rewards, with 30% of the total supply being allocated towards liquidity mining. Note the emission rates halves after the first month. Meaning it will be very rewarding to be an early user! Make sure you follow the team’s Twitter or join their Telegram to follow the latest release updates.

Looking to the future

Currently, the App is live on the Testnet network and has gone through a security audit by Slowmist. So we have a successful mainnet launch to look forward to! No dates have been published yet, however, we could assume it happens once OKExChain exits its Genesis stage. It’s almost certain teams building on OKExChain will receive fast track listings for their native token onto OKEx exchange. So that means this platform should receive a lot of attention quickly.

XAI Staking: We would assume there will be a possibility of minting XAI stablecoin and staking it to farm SXC tokens on launch. This is a low-risk way to stack DeFi strategies, especially if you mint XAI using stablecoins as collateral.

- Remember SumpremeX will support major cryptocurrencies such as USDT, LTC, BTC, ETH, and DOT from launch as it leverages OKExChain’s cross-chain capabilities. Plus there is an easy onboarding route for the masses through OKEx exchange, so TVL will increase fast.

xTokens: The design decision to issue tokens that represent the underlying collateral is very similar to major DeFi protocols such as Curve or Aave on Ethereum. Excitingly, this enables support for vault products such as automated yield aggregators or robo-advisors in the future. Think something like Yearn Finance, on OKExChain. Lots of growth potential here!