What is Typhoon Cash? PHOON Token Review

Typhoon Cash is a privacy-focused protocol on Ethereum for yield-capable private transactions. At its core the protocol functions much like Tornado Cash, however, it supports a much wider range of tokens. Specifically, the protocol enables privacy transactions for yield generating assets (think cUSDT or y3CRV). Essentially, the underlying asset is a deposit in platforms such as Curve or Yearn. Here we will take a look at what is Typhoon Cash, and use cases for its native PHOON token.

It is also the first privacy protocol that will integrate an algorithmic stablecoin. Meaning users will be able to send private transactions for Mithril Cash’s MIC or MIS tokens. As a result, we can consider Typhoon Cash as a privacy protocol ready for the next generation of the DeFi economy.

How does Typhoon Cash work?

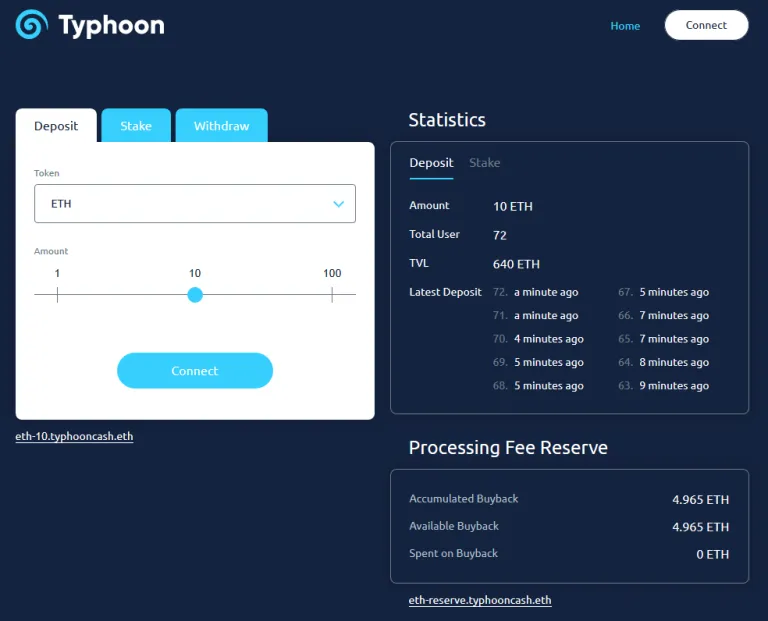

A user generates a random key known as a note, which they deposit into the protocol’s smart contract along with their Eth or ERC20 token. To preserve privacy there are only three specific denominations for each supported asset. For example, if you want to deposit Ethereum it must be 1, 10, or 100 ETH.

To withdraw the user first must stake the note as proof and to specify the withdrawal address. Only then will the protocol allow the asset to be withdrawn. To summarize quickly: a different wallet address can submit the withdrawal transaction and receive the funds. As a result, Typhoon Cash’s smart contract will break the link between the source wallet address and the destination. The idea is that by making it impossible to link the withdrawal to the deposit, complete privacy is guaranteed.

Differences from Tornado Cash

- More Tokens: Typhoon will support privacy transactions for 10 different tokens on launch (ETH, wBTC, cDAI, crDAI, cUSDT, crUSDT, USDT, y3CRV, MIC, MIS).

- Buybacks: there is a 0.5% transaction fee on all PHOON transfers. The fee goes to a smart contract that automatically buys and burns PHOON tokens.

- No Relayers: Users will not be able to withdraw funds to empty wallet addresses as Typhoon will not support relayers. However, the team plans to enable this functionality in the future by using Keep3r Network.

PHOON Tokenomics

The Typhoon Token (PHOON) main use case is for governance, meaning holders will have voting power over the protocol’s future developments. It features a fixed total supply of 27,800 tokens with allocation being as follows:

- Rewards: 88% (25,666 PHOON) will be distributed as rewards to users staking coins in the anonymity pools (notes) or supplying liquidity to the PHOON/USDT, PHOON/MIC pairs on Sushiswap.

- Initial liquidity: 2% (600 PHOON) will be used to add liquidity to the initial pairs.

- Reserve: 10% (3,000 PHOON) is allocated to the protocol reserve, which is controlled by the Typhoon DAO.

Potential for Growth?

As seen above the launch is 100% fair distribution without any tokens under team control. Furthermore, the protocol’s solidity code went through a security audit by ctdsec. The report concludes that the smart contracts are safe to deploy and do not contain any malicious admin commands. My main takeaway is that by enabling more assets, Typhoon Cash should attract a lot more users than Tornado Cash. This will translate into more buying pressure for PHOON, due to the automated buybacks.

1k-y3CRV pool1 APY 129k% pic.twitter.com/044ABj9OlP

— TyphoonCash (@TyphoonCash) January 21, 2021

Lastly, the yield farming opportunities for PHOON tokens look very attractive for early adopters. Currently, the APY is over 129k% for certain pools. Don’t wait around!

You can learn more about Typhoon Cash by following their Twitter or joining their Telegram group.