What is UniCrypt? UNCX and UNCL Token Review

UniCrypt is a decentralized services provider which offers several ways for DeFi projects to build community trust and keep users safe. Famously, UniCrypt created the first-ever liquidity locking smart contracts for Uniswap on Ethereum, known as Proof-of-Liquidity or POL. From there the project continued to develop new features, combining liquidity locking with a decentralized launchpad. Here we will take a look at what is UniCrypt along with reviewing the tokenomics of UNCX and UNCL.

UniCrypt Services

Currently, we find three core services on the platform:

- Liquidity Lockers: these are smart contracts that enable teams to publicly lock liquidity on Uniswap or other AMMs for a predetermined period. Essentially, it’s a guarantee to investors that the project developers can’t drain the pool of all the funds. A key innovation is UniCrypt’s lockers will be able to migrate liquidity to Uniswap V3 when the time comes.

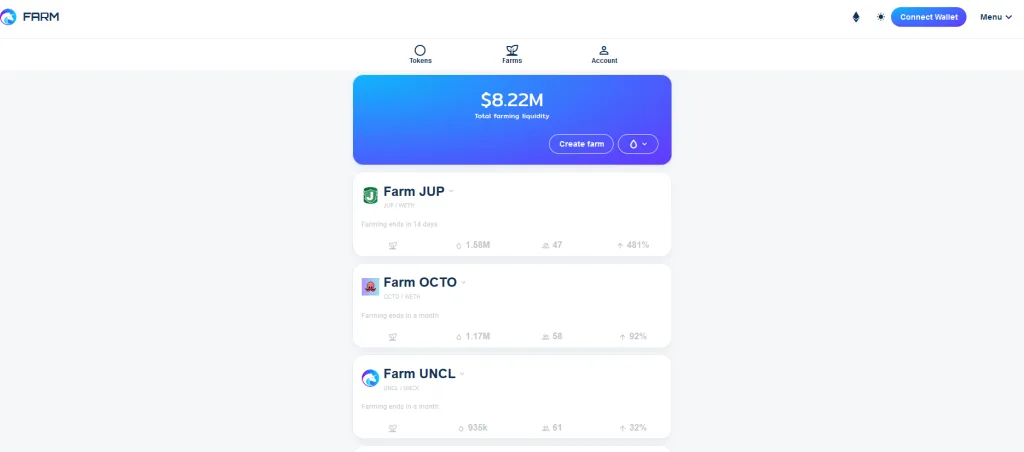

- FaaS: This is a yield farming-as-a-service protocol that enables the creation of a farm for any token. Launch a farm in a couple clicks using the UI, all automatic with no coding necessary.

- Launchpad: Perhaps the most interesting service, a 100% decentralized and automated presale platform that is connected to the liquidity lockers. Once the presale ends a portion of the raised funds (between 30% to 100%) will create the DEX pair on a supported AMM and the liquidity will be locked.

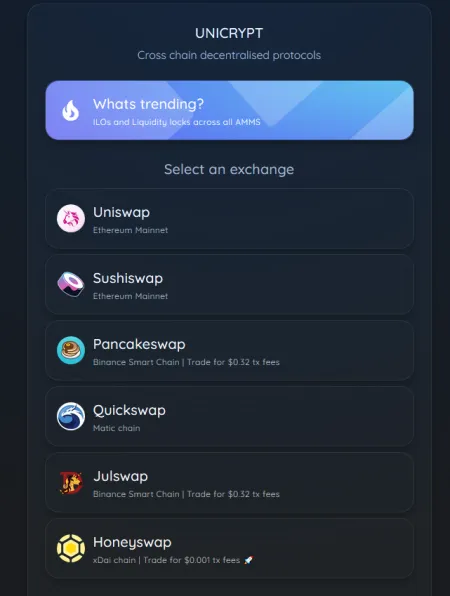

The platform also features a trending filter that lets you quickly find new ILOs or token locks across all networks.

- Sidenote the UI on this platform is 10/10, hope other DeFi developers are taking notes!

Remember all the tech on UniCrypt is available for anyone to use meaning it is an open market. Of course, that’s the beauty of decentralized finance, just always do your own research before entering any sale.

Tokenomics

The UniCrypt is a two token ecosystem, UNCX is a deflationary governance token that provides holders with voting power. And, UNCL is an inflationary token for farming rewards.

UNCX Token

The main use case is holding 4 UNCX to participate in Round 1 (which is the first 2 hours) of a token sale via the launchpad. Currently, the total supply is 48,650 UNCX and no new tokens will ever be minted. The supply can only go down as the team will randomly burn UNCX through buybacks from collected protocol fees.

UNCL Token

A reward token for liquidity providers on certain Unicrypt farming pools. Additionally, you can participate in Round 1 of presales on the launchpad by holding 50 UNCL. Furthermore, UNCL’s inflation rate is halved every year to ensure token emissions are not too high.

One difference is on the xDai blockchain where the top 100 UNCX & UNCL holders will also receive a share of the generated presale fees on that network.

Looking to the future

UniCrypt is offers services for tokens across four networks: Ethereum, Binance Smart Chain, xDaiChain, and Polygon. Great to see the development team is not falling victim to any tribalism around one blockchain. Currently, the platform supports liquidity locking for six different automated market makers: Uniswap, PancakeSwap, JulSwap, HoneySwap, SushiSwap, and QuickSwap. Meaning there is a big potential to add support for more AMMs to increase revenue, think 1inch or SwipeSwap. Remember fees are used to buyback and lock or burn UNCX/UNCL tokens.

More Partnerships: Currently, UniCrypt is an official partner of the analytics platform DexTools, has auditing partners such as ChainSulting and Hacken, and a KYC partner Pinpoint Capital. Given that UniCrypt’s services are all aimed at making the DeFi space safer for users, our opinion is the potential for strategic/collaboration partnerships here is endless. For example, major players such as Solana or Cosmos would consider UniCrypt a positive asset to their emerging ecosystems. Expecting to see announcements as the platform grows!

- Note that UNCX & UNCL also exists as BEP20 tokens. In the past Binance exchange has been quick to list innovative DeFi projects building on BSC. Just speculation at this point, but something to consider!

New Networks: The dev team is already proving they’re comfortable building on any EVM compatible blockchain so we could expect to see releases on Fantom, Huobi Eco Chain, or TomoChain next. Exciting times ahead!