Will Polkastarter be bigger than Uniswap?

Polkastarter is a decentralized exchange (DEX) for cross-chain token pools, built on Polkadot. Decentralized finance (DeFi) products have made huge leaps, with many successful projects such as Uniswap or Aave. Protocols are trading or locking up billions of USD value in cryptocurrency. For the first time, we are starting to see a future of crypto which is not just deposits on centralized exchanges. Yet the rapid growth has brought along notable scalability problems. Especially on Ethereum, with network fees and slowness, driving users back to CEXs.

Enter Polkastarter

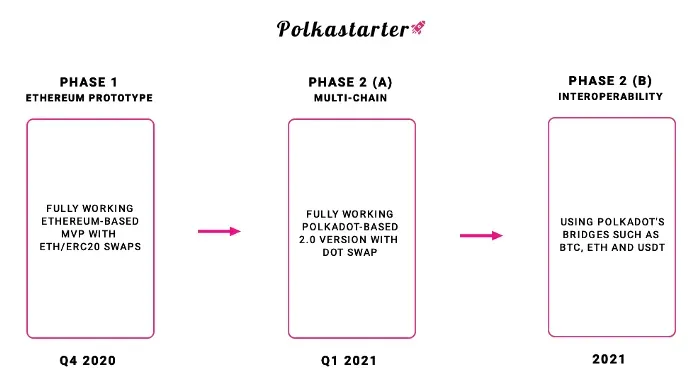

Polkastarter is the next step for innovating DeFi, one where projects embrace interoperability between blockchains. Meaning they are not just operating on a single network. Polkastarter will power cross-chain token pools and auctions by leveraging the power of the Polkadot network.

In The Same Flavour:

- Cross-chain DeFi about to explode? Polkadot to Ethereum bridge

- What is Pickle Finance? Bringing Stability to DeFi

- All Eyes on Dock’s PoA Mainnet Launch

As a result, the platform can provide faster and cheaper transactions while remaining connected to the Ethereum network (or other blockchains) for liquidity.

Will Polkastarter eclipse Uniswap?

Polkastarter is not another food theme DeFi clone that has copied Uniswap smart contracts. The platform will enable the token pools to have several different types of swaps: fixed ratio swaps, dynamic ratio swaps, dutch auctions, and even sealed-bid auctions. You will even be able to create private pools with passwords.

Raise capital… With the new token pool features and cross-chain transfers built-in, Polkastarter can become an industry leader for raising capital in a decentralized/fair launch environment. Decentralized token offerings do happen on Uniswap, but if you’re not quick then you will miss the best price.

- The platform also has a native utility and governance token POLS. Token holders will be able to vote on product features, as the platform intends to be governed by its community.

Token use case and value… POLS tokenomics have been designed to ensure the token’s price is correlated to platform usage. Because it is not only a governance token. Traders will need to pay transaction fees in POLS for swapping tokens. Additionally, there is a requirement for pool creators to hold POLS tokens.