Double Farming with SashimiSwap

You may have labeled SwashimiSwap as another DeFi food-themed clone, and not given it another look. That would be a mistake. The Aelf development team has been busy adding innovative features to ensure maximum capital efficiency. Users can now enjoy double farming, earning SASHIMI and UNI, by staking one LP token to SashimiSwap.

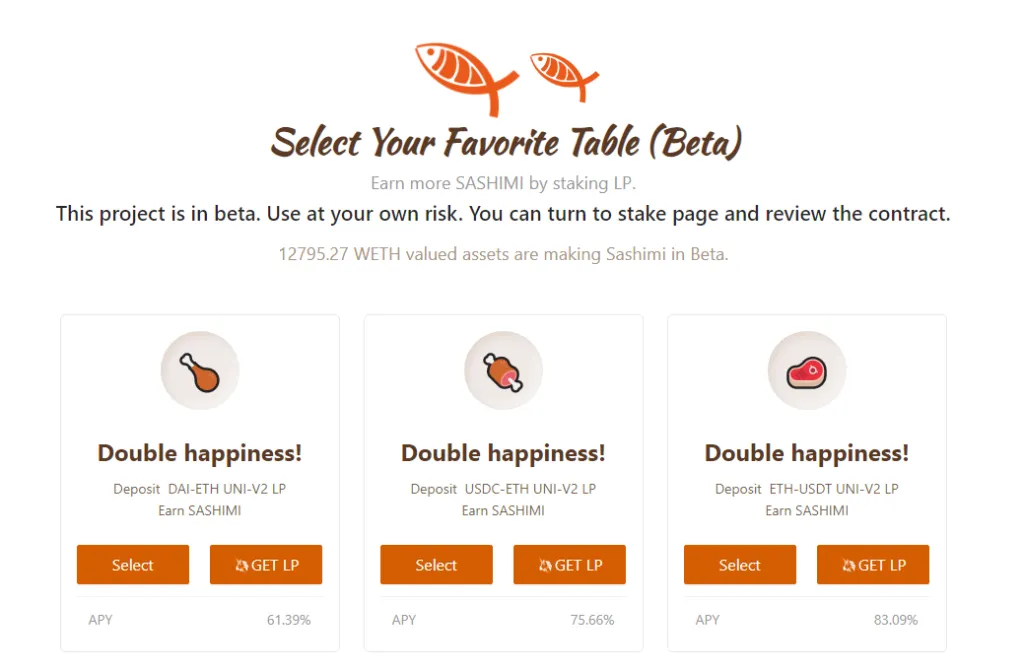

Double Farming, Double Rewards

SashimiSwap aims to solve a painful issue with AMM-based decentralized exchanges: many times locked up capital is sitting there idly. It is great to have millions of USD value in a liquidity pool, but there is only so much capital needed to meet the current demand for token swaps.

The answer, according to SashimiSwap, is to put that idle capital to work and generate additional returns for its users. Effectively, the platform is combining the best features of Yearn Finance and Uniswap under one banner.

Asset management feature… called SashimiSwap Investment, the feature uses idle assets in the pools to obtain additional income via a DeFi vault product. Vaults are products to optimize your yield farming, popularized by YFI token. They automatically locates the DeFi protocol with the highest returns to make the most money.

- The platform’s DeFi vaults are not live yet, according to their latest AMA, users can expect them to go live shortly.

Sashimi buyback… All returns that the protocol generates through managing the idle assets in liquidity pools will buy back SASHIMI tokens. The idea is to create a positive feedback loop for boosting the token’s value. Furthermore, 75% of the SASHIMI bought back will go straight into the Sashimi Bar Contract. This means that users who stake their SASHIMI will receive extra profit through the buyback tokenomics. Additionally, the remaining 25% is destroyed permanently, which makes SASHIMI a deflationary token.