What is Kava? A Cross-Chain DeFi Platform

Kava has set its sights on becoming the default DeFi platform by enabling an easy cross-chain experience. The project aims to provide decentralized lending against all major crypto assets in the form of stablecoins. At its core, Kava feels very similar to MakerDAO with CDPs. However, where Maker limits itself to Ethereum ecosystem Kava plans to leverage the interoperability of the Cosmos blockchain.

Meaning that it can support independent networks such as Bitcoin or Binance Chain natively. There is no need to wrap assets and use bridges to move tokens from one network to another.

How does Kava DeFi platform work?

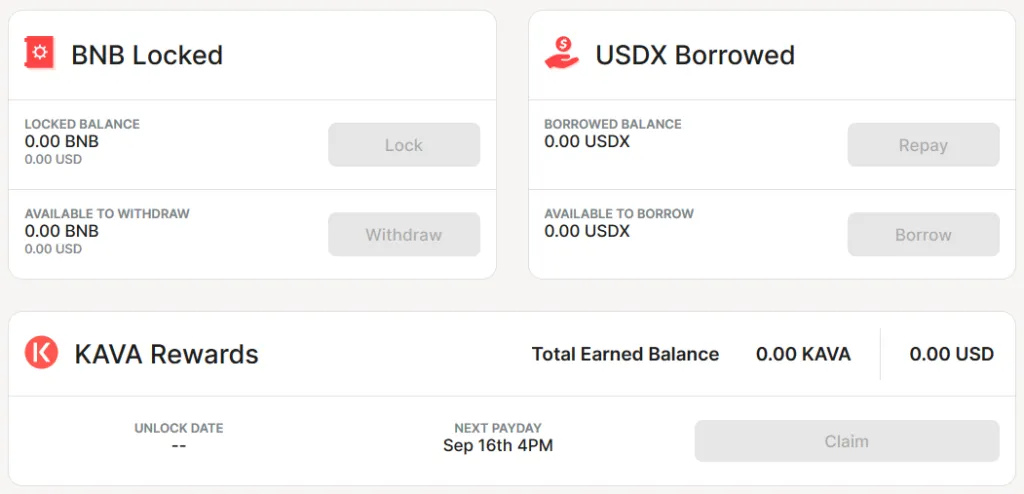

As a cross-chain DeFi platform, Kava offers collateralized loans and stablecoins to holders of major crypto assets such as BTC, XRP, BNB, or ATOM. Users can mint USDX Kava’s stablecoin in exchange for collateralizing their crypto assets.

Quick Bite

The value of the protocol is the ability to create synthetic leverage for any supported crypto asset. For example, you can lock up BNB as collateral and mint USDX to buy more BNB. Now you have a leveraged long position on BNB.

- Binance exchange has integrated Kava for BNB DeFi staking programs, offering up to 25% APY for staking BNB.

Deep Dive

Kava follows a Proof-of-Stake (PoS) consensus model where the governance token KAVA is a network validator through staking. As a result, holders can stake to earn more tokens in the form of block rewards or transaction fees. The token also gives voting power, such as deciding which type of crypto assets are used as collateral. Furthermore, KAVA is the protocol’s reserve currency if ever the system is under-collateralized. In this scenario, new tokens are minted to buy USDX off the market until the system is safe.

Looking to the future… for the platform to integrate with more wallets, exchanges, and financial services the Kava lending platform needs more USDX minted. To become a global financial system and DeFi giant, there needs to be enough USDX liquidity. As a result, we recommend watching their announcements. As there will surely be more incentive programs offering generous rewards for minting the USDX stablecoin.