What is N3RD Finance? N3RDz Explained

N3RD Finance is a decentralized finance (DeFi) protocol living on Ethereum. It aims to provide users with a full suite of yield farming products, powered by its native N3RDz token. Here we will look at what is N3RD Finance, along with the key N3RDz token features.

N3RDz Token Explained

Every time there is a N3RDz transaction a transfer fee applies. 90% of the fee goes towards farmers as rewards and 10% goes to a development fund. Essentially, this is a process known as deflationary farming where the protocol will never mint new tokens. Additionally, N3RD Finance ensures there are no barriers to enter a vault with their one-click code. Meaning users can buy the vault’s LP token and stake instantly. There is no need to first add liquidity to a Uniswap pool and then manually stake for rewards.

N3RD Finance ROADMAP

— N3rd.finance 🤓 (@nerdfinance1) December 16, 2020

2 weeks since N3RD is live

🏦 ETH vault 900%APY

📈 N3RDz Daily volume 1million$

👥 1000 community members

🚫 NO ICO, NO PRE-SALE

✅ Launched with only 60 ETH LGE

🔬 ARCADIA AUDIT ON THE WAY

🚀 30X in 2 weeks

Not enough?

Here is our ROADMAP 👇$NERDz pic.twitter.com/IWtKXNyKuy

Currently, the team is focusing on releasing DeFi products that automatically maximize the yield of a user’s deposit known as Vaults. It’s great to see the smart contract code is going through security audits by TheArcadiaGroup.

Deflationary Farming

There are only 21,000 N3RDz tokens, the total supply will not change and farming does not create any new coins. The protocol uses the token’s transfer fee to ensure rewards stay sustainable long term.

- This is a concept inspired by CORE’s locked liquidity mining, however, liquidity providers on N3RDz are only 100% locked in for 1 month. They can then withdraw liquidity gradually over 10 weeks.

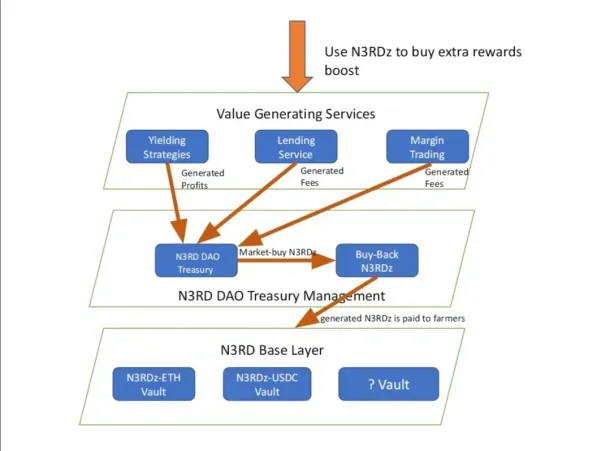

Looking to the future… This is very early days for N3RD Finance, as seen in the above diagram the team is building out the base Vault layer of the protocol. Plans will see the release of various products that leverage the liquidity in the vaults. Such as lending services, a margin trading DEX, and gaming NFTs. All services will generate fees for N3RDz buybacks – constant buy market pressure!