What is Pickle Finance? Bringing Stability to DeFi

If you thought the decentralized finance (DeFi) summer craze of food inspired tokens was over, well you would be wrong. Pickle Finance is a new DeFi platform which is aiming to bring higher stability to well, stablecoins. The idea is to give more rewards to below peg stablecoin pools, and fewer rewards to above peg stablecoin pools. As a result, users are incentivized to sell their above peg stablecoin and buy the below peg one. Which in turn, helps the stablecoin keep its value correctly pegged!

What is Pickle Finance?

If you have been following new DeFi protocols over the past weeks, it’s hard to remember a time where they did not have food-inspired names. Developers seem to have been on a craze of copying each other, but packaging the product up a little differently, such as SushiSwap or Kimchi Finance to name just a few. Many of these tokens pumped and dumped rapidly, many more turned out to be complete scams, given the founders were generally anonymous.

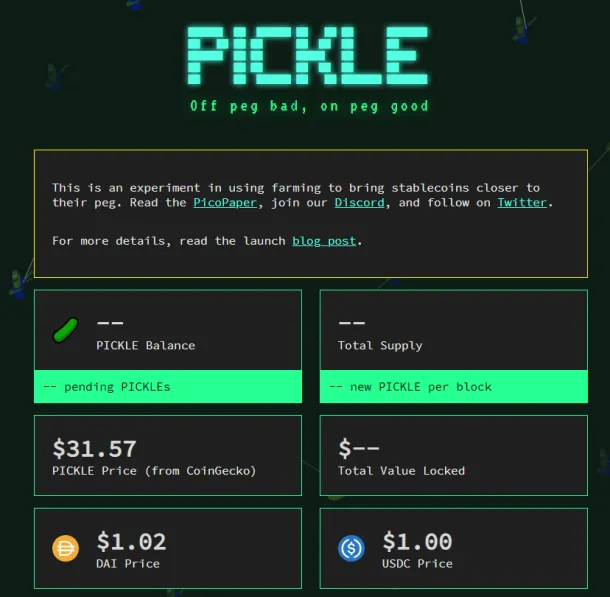

Pickle continues to gain traction… Pickle’s website looks quite similar to any other food coin. But, the project’s goal is much different. Here the platform is not trying to vampire attack liquidity from Uniswap or Balancer. The idea is to use the PICKLE token as an incentive to reduce the premiums found on certain stablecoins. A new form of yield farming!

- For example, DAI or sUSD has been trading at 2 to 4 percent above the dollar over the past month. So the platform has a use case!

Looking to the future… DeFi enthusiasts seem captivated by this simple approach of using market pressure to create stability. The token PICKLE is currently trading at around $31 which means it is up by 600% from its all-time low of $4, in just a couple of weeks.