dForce’s Yield Markets Explained

After dForce suffered a notorious hack of around $25 million, dForce went back to the drawing board. After several security audits before re-launching, dForce is starting to make a comeback into decentralized finance (DeFi). Here we will take a look at their Yield Markets and Liquidity mining programs.

A DeFi Aggregator with a twist

Mindao Yang, co-founder of dForce, believes that standalone DeFi protocols such as Aave or Maker do not have the competitive edge. Meaning they cannot capture all the ecosystem’s rewards for their users. The future belongs to platforms providing aggregation and matrix products, that users can easily access.

USDT/DAI and increasingly USDC are aggregators of liquidity in the shadow, they are the true kings in the yield farming and aggregation exercises; Aggregation as a Service sucks as a value capture, but if it's an asset protocol, it's a super sticky supernova

— Mindao Yang (@mindaoyang) July 31, 2020

We have all watched the summer craze of YFI and SUSHI cause a huge demand for DeFi tokens from investors.

However, the problem with being a simple DeFi aggregator is that they can be easily cloned and copied. Just take a look at Dfi Money, xFinance, Harvest Finance – the list goes on. As a result, dForce is on a different path for aggregation. Essentially, the idea is to not simply be a aggregator as a service but as an asset protocol.

Aggregation as an asset?

By becoming a decentralized finance aggregator of the aggregators liquidity providers will remain loyal to using dForce. Currently, we see many users who move on to Curve as soon as the potential rewards are better.

You May Also Like:

- Yearn Finance Vaults Explained

- What is Shell Protocol? Flexible Liquidity Pools

- Farming on Binance Smart Chain with PancakeSwap

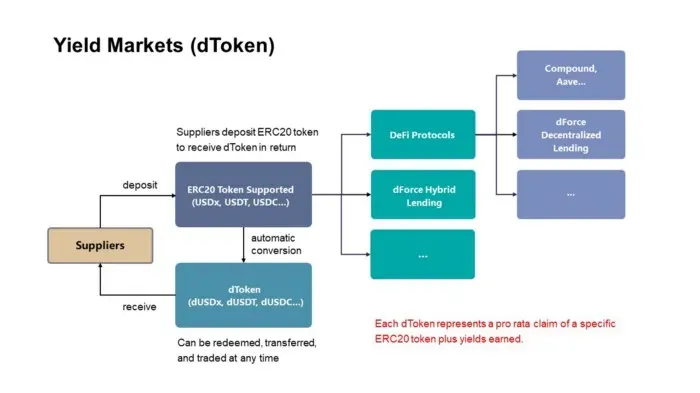

With dForce the approach is to integrate all DeFi protocols vertically and horizontally.

Essentially, users can earn value from all of the rewards on offer around the ecosystem. We find similar innovations happening in platforms like Value DeFi or Dracula Protocol.

Key Features

- dForce offers risk-adjusted yield farming as deposits will be pooled across multiple DeFi stacks. Thus, less risk if a protocol such as Compound collapses and you only have cTokens.

- All governance tokens are automatically harvested and compounded into the underlying yield.

- No impermanent loss risks, as dforce’s yield markets do not feature any AMMs.

- Built for maximum Gas efficiency. The protocol includes an internal buffer for users depositing and withdrawing. Therefore, it does not need to interact with the underlying protocol on each action.

Additionally, when a user deposits funds they are given the corresponding dToken in return. All dTokens follow the ERC20 standard. As a result, they are compatible with Balancer pools for liquidity and support quick stablecoin swaps.