Doki Doki Finance and DOKI token Review

Doki Doki Finance is a DeFi protocol focusing on building a full suite of products that capture sustainable and long term value for its users. DOKI tokens reward participants of the ecosystem through staking, along with providing token holders governance rights.

What is Doki Doki Finance?

Doki Doki in Japanese refers to the sound of a heart beating quickly, usually for the excitement of what’s to come. Which is why you find a unique retro-Japan inspired interface on their website. The team aims to develop products presented in a stylish way that will provide a Doki Doki feeling for users!

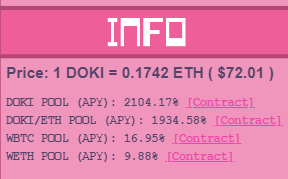

Currently, the main product is DStake which distributes DOKI tokens via 4 different pools. The bulk of the rewards go out to the two DOKI staking pools which the protocol considers higher risk.

This design choice intends to avoid a market collapse via unsustainable APYs that attract whale farmers into early dumping. Many DeFi platforms offer high APYs for very low-risk pairs such as $ETH/$USDC or $WBTC/DAI. However, Doki Doki aims to create a loyal community of DOKI holders and liquidity providers.

DOKI Tokenomics

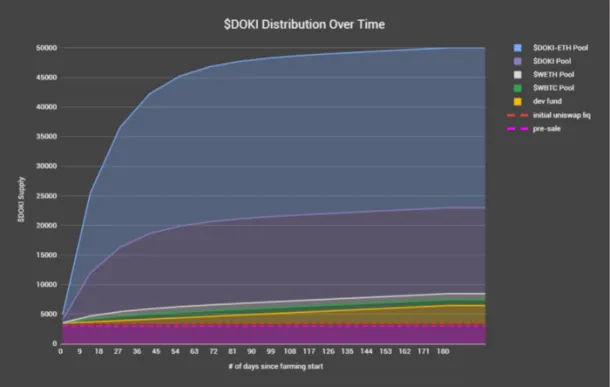

There is a fixed total supply of 50,000 and most of the tokens will be distributed by the staking pools. As a result, there should not be any concerns about over emission or infinite inflation using this platform. Additionally, the protocol halves the daily rewards emission every two weeks. Meaning 99% of DOKI’s supply will distribute within the next 5 months.

The important part to understand about the DOKI tokenomics is the TAX feature present in the token’s smart contract. This resembles a burn feature upon selling, but the tokens go into the treasury. Currently, this is set to zero, however, once the decentralized treasury is live token holders could vote to set a tax. Essentially, the idea is to use the TAX feature to collect development funds and remain sustainable long term.

Looking to the future

Note that the project is only in Phase 1 of its development, so there are a lot of future upgrades to look forward to. Let’s take a quick look at what’s to come in Doki Doki Finance.

- DTreasury: this will be a decentralized development fund for ecosystem grants, governed by token holders. The interesting part is the treasury acquires funding by taxing any DOKI sells.

- NFTs: given the unique theme, non-fungible tokens in the form of retro collectibles should prove very popular. The team states this will follow an NFT mining model inspired by Don’t Buy Meme.

- DSwap: no DeFi suite would be complete without its own automated market maker. Excitingly, the team mentions new hidden features that will set them apart from SushiSwap or Uniswap.

- Second Token: Users can also look forward to farming a second token by staking DOKI, which will have an elastic supply much like BASED or VAMP.

- DBank: this product will resemble vaults enabling users to earn yield from depositing stablecoins. It will also include a decentralized insurance system.

Once the full suite of DeFi products is up and running, there should be a massive amount of value flowing into the Doki Doki ecosystem. All coming back to DOKI holders!