What is DIA? Open Source Oracle Platform

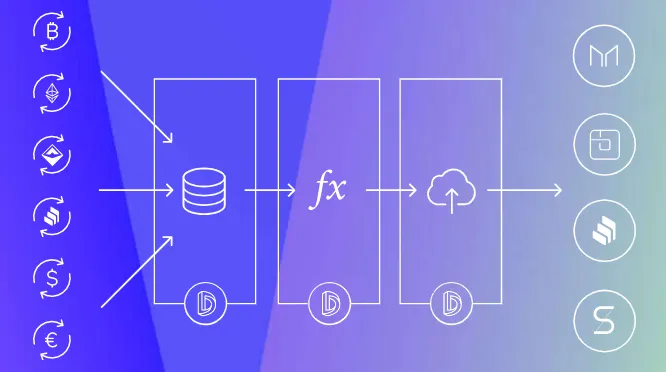

DIA (Decentralised Information Asset) is an open-source platform for sourcing, supplying, and verifying data that powers the decentralized finance (DeFi) economy. This is a key infrastructure component that DeFi applications require to be reliable, commonly, known as an oracle. Here we will learn what is DIA token, how it powers the platform, and explore the team’s oracle design.

What is DIA Token?

DIA Labs aims to provide trusted oracles for DeFi applications, with reliable data feeds that can scale. For example, if the data feeds of a DeFi product can be manipulated by malicious actors then the product can become exploitable. For products that deal with decentralized lending, yield farming, flash loans, and margin trading it becomes crucial for the pricing feeds to work off validated data streams. Alternatively, the protocol can be tricked to give up money when it shouldn’t. As a result, DIA is operating in the same DeFi oracle space as Chainlink, Band Protocol, or Tellor.

By using a crypto-economic incentive, DIA leverages the wisdom of the community for sourcing and validating data. The team believes that a fully transparent solution that incentivizes community participation is the optimal outcome for the data infrastructure powering the DeFi economy. As a result, all of DIA’s data feeds are open-source and accessible to everyone. Meaning all of the historical data is fully auditable.

DIA Token Use Cases

The DIA tokens have the following use cases in the ecosystem:

- Governance: development is community-driven meaning DIA tokens provide holders with voting power.

- Verification: DIA tokens can be staked to earn rewards, as a way to validate data provided by existing oracles and also to resolve any disputes.

- Payment: To access live data streams and certain APIs developers have to pay with DIA tokens. Historical data is accessible free of charge.

Future Growth?

It’s become clear that Oracle technology is going to play an immense role in the future of decentralized financial applications. For example, such as managing crypto indexes like PieDAO or DEXTF where pricing feeds for asset ratios are key. Furthermore, DeFi is the cryptocurrency sector growing the fastest across various networks such as Ethereum, Polkadot, and Binance Smart Chain. Any project such as DIA building an integral infrastructure component stands to gain massively.

Market caps of major oracle networks:

- LINK: $5B

- BAND: $137M

- TRB: $38M

- DIA: $30M

Moreover, in a landscape filled with developers that champion decentralization it seems very hard to believe just one oracle project will capture the value of the whole ecosystem. It’s too early to say if DIA will overtake industry leader Chainlink, but there is so much growth potential, it probably doesn’t even matter! Should be part of any oracle focused crypto index portfolio.