What is Flamingo Finance? DeFi platform powered by NEO

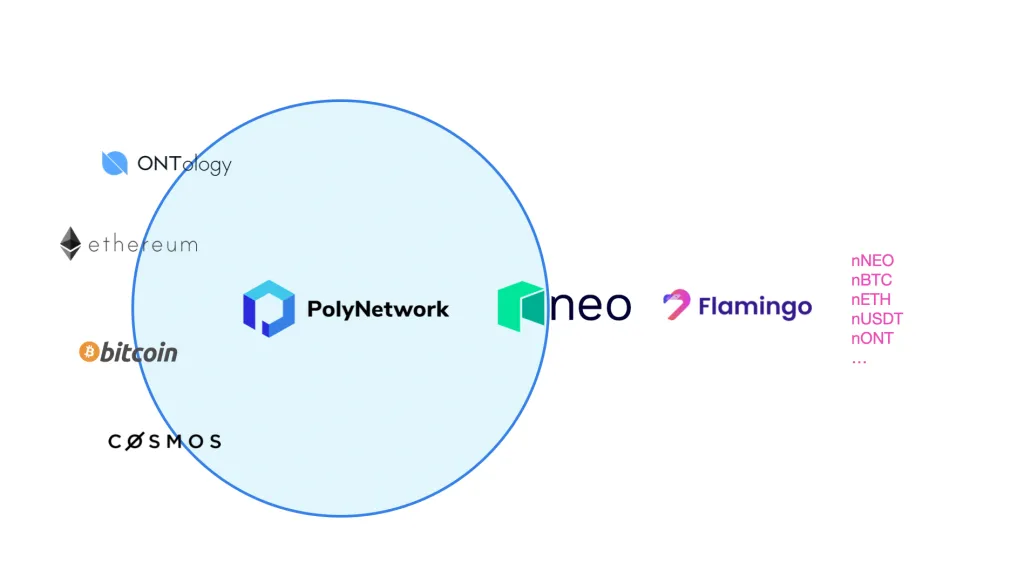

Flamingo Finance aims to combine everything a DeFi enthusiast would need in one platform. The project is the first major DeFi product living on the NEO blockchain. As a result, users avoid the high cost of transactions of Ethereum. Currently, Flamingo Finance leverages NEO’s native interoperability tech to provide cross-chain swaps between Bitcoin, Ethereum, NEO, and Ontology.

What is Flamingo Finance?

Flamingo intends to be an all-around service for DeFi products powered by NEO. It features an automatic market maker that resembles Uniswap. Liquidity providers can supply crypto assets to earn fees from swaps and rewards. However, liquidity pools use NEO tokens which follow the NEP-5 standard. Flamingo makes it very easy to convert tokens through its Wrapper technology, a cross-chain asset gateway. Via the wrapper gateway, users can convert BTC, ETH, USDT, ONT into their corresponding NEP-5 token.

Flamingo is also a DeFi lending platform, where users can deposit crypto assets as collateral to mint stablecoins as a loan. The first stablecoin is Flamingo USD (FUSD) which is pegged to the US Dollar. The main difference compared to Venus or MakerDAO approach is that Flamingo will collateralize liquidity provider tokens instead of the asset directly. Meaning they have combined an AMM and money market into one product. This is a very interesting approach, which will enable Flamingo to use capital more efficiently than just letting it sit idle in a pool.

You May Also Like:

- 7 Reasons Swipe (SXP) DeFi plans with Binance Chain will rocket

- Yfv Finance launches Value Vaults

- Start Balancer Liquidity Mining to earn BAL tokens

With stablecoins issuance, traders will also be able to enjoy perpetual contracts that use the platform’s AMM pools for high liquidity. Flamingo’s exchange will offer a leverage of up to 10X for long or short positions.

What is Flamingo Finance Token (FLM)?

FLM is the platform’s native currency, its main purpose is for governance. Token holders will be able to vote on proposals to govern the platform, such as which crypto assets to support. The project has followed a fair launch with no pre-mine or coins allocated to its founding team. All FLM tokens will be distributed to the community through liquidity mining. Subsequently, rewards for using the platform are in FLM tokens. For example, FLM may be given to users who provide liquidity, stake LP tokens, mint FUSD, or traders who margin trade.

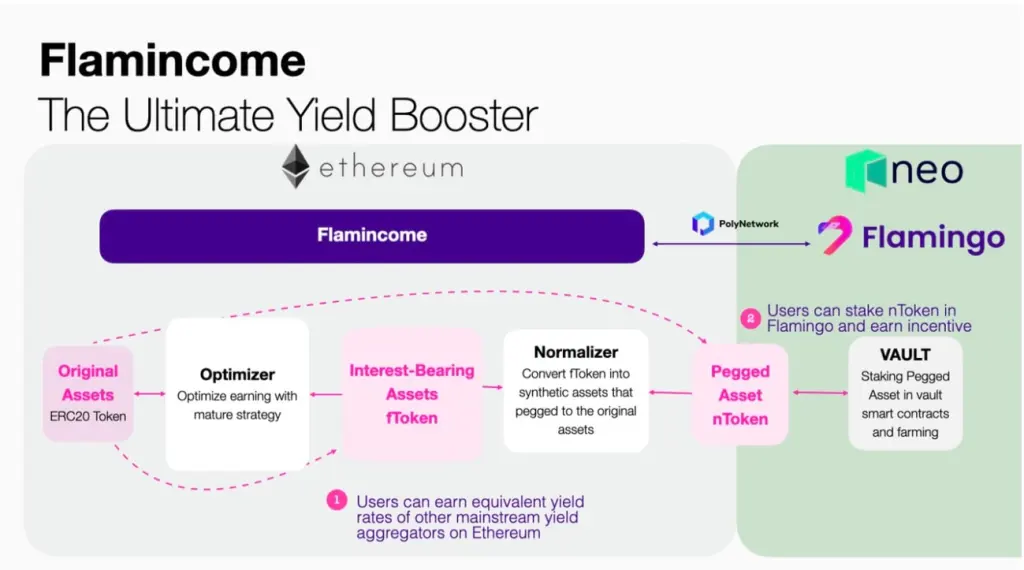

What is Flamincome?

Once everything is up and running, the team aims to make it very easy for users to earn the maximum amount of yield or liquidity rewards. This will be possible via Flamincome, which provides functionalities that look very similar to Yearn Finance or Value Finance DeFi vaults.

Flamincome will automatically optimize your deposits for the best yield farming or liquidity mining returns. Excitingly, it will also be able to generate synthetic assets for depositing into other DeFi protocols for additional liquidity mining.