Xiotri DeFi’s Unique Liquidity Mining Algorithm

XIOTRI DeFi is a fresh approach to liquidity mining, one which aims to provide value for all participants in a fair approach. Currently, we find many yield farming platforms are ravaged by whale portfolios looking to dump some free DeFi rewards.

What is XIOTRI DeFi?

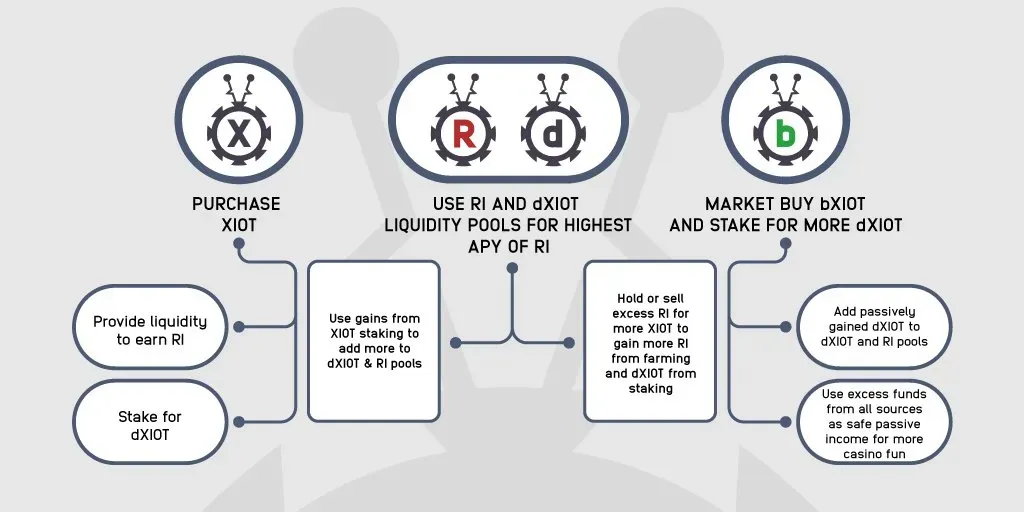

Xiotri DeFi’s algorithm provides disincentives for being overly greedy. Meaning the protocol works to enable more users to participate in staking while keeping the rewards balanced. This is an approach we have seen in projects such as DEGO Finance where stakers are put into tiers. Essentially, the platform works to emit its reward/governance token Ri in a way that will keep the ecosystem in balance. The aim is to avoid a scenario where larger portfolios earn massive amounts of Ri. And, immediately dump them causing the ecosystem collapse and move on.

This is a common problem that farming operations are coming across, one that destroys trust with its users. One reason why some teams are now locking liquidity. Because, when the platform’s reward token price collapses the biggest victims are the smaller portfolio farmers.

Four Token Ecosystem

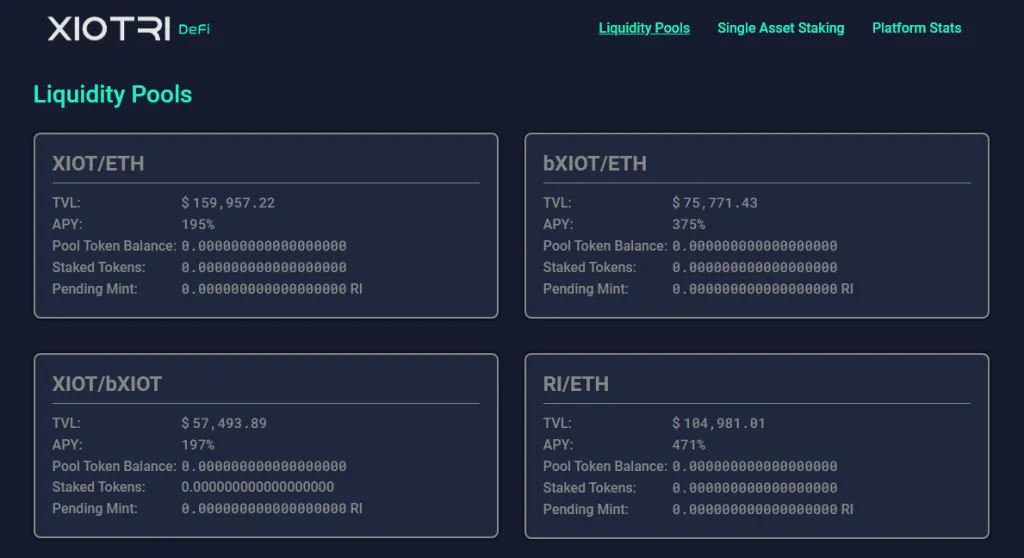

The project has three main tokens XIOT and bXIOT, and dXIOT for staking and routing liquidity. Users can earn dXIOT by single staking XIOT, bXIOT, or RI. And, all pool pairs for liquidity providers to farm RI are with the platform’s native tokens. Ri token is also stakable, as a result, the platform aims to become a giant 3 token liquidity mine.

- The team is remaining tight-lipped on how exactly their sustainable DeFi reward algorithm works. Note that the platform is still in beta, not all the functionality is live, and there have not been any audits as of yet.

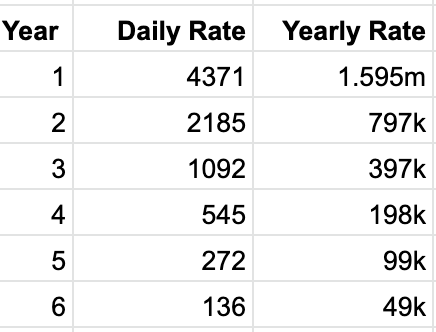

Inflation reduces… Ri emission follows a design that halves the rewards once per year. Currently, this is planned to happen over a period of six years. Meaning this is a farming operation users could definitely stay in long term: stake and forget!